What might kill WeWork?

The company thrived on a superior understanding of its customers’ needs. But its business model makes it vulnerable.

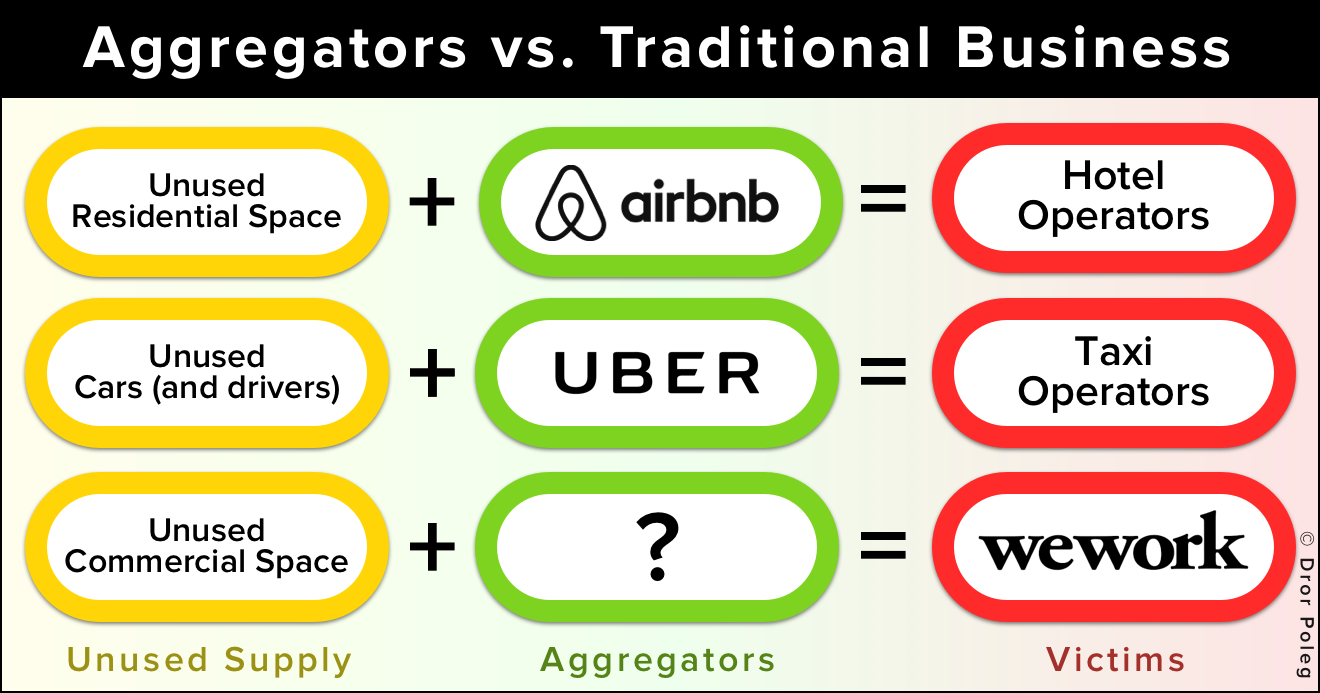

Traditional hotel companies have high operating costs and require heavy investment in design, fit-out, and (sometimes) the acquisition of whole buildings. Their business is built on strong branding, proprietary management tools, and a global network that caters to diverse needs. AirBnB offers a comparable value proposition without owning or fitting-out a single building. It does so by aggregating millions of under-utilized rooms under a single, reliable, and easy-to-use platform.

WeWork is the world’s largest operator of co-working spaces. Its business is built on a strong brand, proprietary management tools, and a global network that allows it to cater to diverse needs. The company does not shy away from heavy investment in fit-out and design and is moving further towards becoming a property owner as well as operator.

At its core, WeWork is in the business of developing supply and generating demand for its own spaces. AirBnB, in contrast, is in the business of aggregating existing supply and monopolizing demand for anyone’s spaces. Once you control demand, suppliers become a commodity (Can you name a single AirBnB “host”? How about an Uber driver? You can’t, because hosts and drivers are interchangeable and all that matters is your relationship with Uber and AirBnB).

WeWork is a great real estate operator. It relies on strong branding and a superior understanding of customer needs to maximize yields. But its business model is not fundamentally different from that of traditional operators such as Hilton, Westfield, Hines, or Regus. The company differentiated itself by bringing elements of the shared economy into traditional real estate, allowing flexible access to great office space. This means high upfront costs coupled with unstable demand from the world’s most fickle consumers. What could possibly go wrong?

On the one hand, traditional property owners that focus on long-term leases have strong relationships with large tenants, more patience, and probably a lower cost of capital than WeWork. Those of them who wish to experiment are discovering how easy it is to convert existing offices into co-working spaces (especially when you focus on function, not on fluff). Second or late movers have unique advantages in an industry that requires so much upfront investment.

On the other hand, new types of competitors are moving into WeWork’s territory: Spacious.com provides 9–5 access to workspaces located in restaurants that are otherwise closed during the day; Breather.com provides on-demand access to small, under-utilized spaces in central locations. Both companies offer a comparable value proposition without owning any property or making significant investment in fit-out. And there are others.

In the title, I used the word “what” and not “who”, since WeWork can shift its focus towards an “asset light” aggregation model or towards larger tenants who sign longer leases. But the bigger and more comfortable a company gets, the less likely it is to change its business model. Ironically, startups focused on incumbents at the top of the market tend to be complacent about disruption at the bottom.

Dror Poleg Newsletter

Join the newsletter to receive the latest updates in your inbox.