AI, Remote, and Office Demand

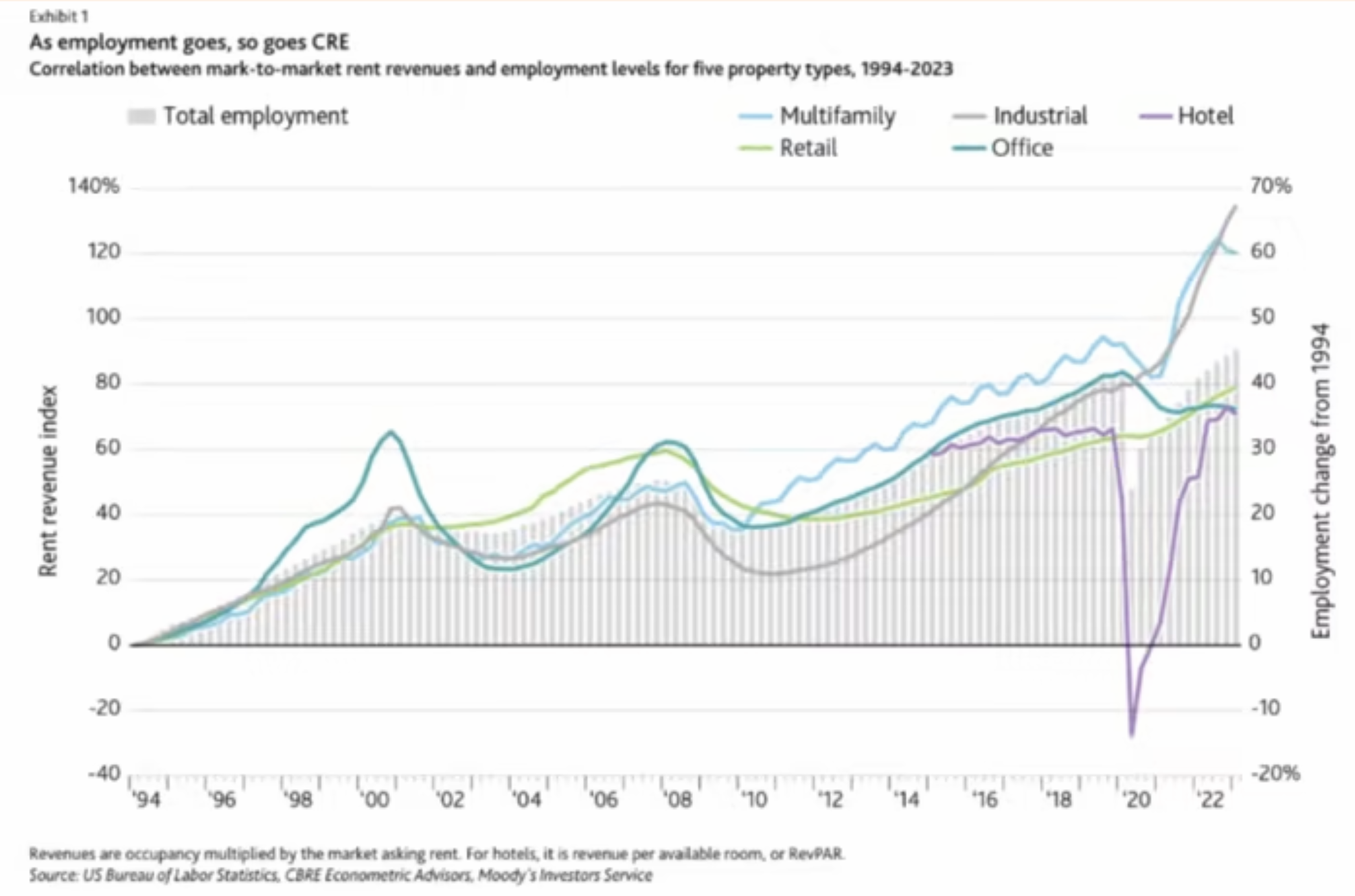

Recent data shows a decoupling of economic activity and commercial rents.

🚀 The upcoming cohort of Practical AI begins in one month! Join me to master the latest tools for marketing, financial analysis, and general business automation. The schedule is optimized for participants in Asia-Pacific and the US. Learn more here.

How much office space does the world need? Until recently, there was a relatively straightforward answer to this question. As I pointed out in Rethinking Real Estate:

In the twentieth century, business success was mostly correlated with physical expansion. Consider, the model used by the Commercial Real Estate Development Association (a.k.a. NAIOP) to predict demand for office space. The model relies on macroeconomic variables such as gross domestic product, corporate profits, and total employment, as well as forward-looking delivery and inventory data for non-manufacturing industries. According to the model, employment in the financial sector had a very strong relationship with net absorption of office space between 1988 and 2014.

That was fine. However, as I mentioned in the book, "2024 might be very different from 2014" due to remote work and the automation of white-collar work. In 2019, when I wrote the book, the impact of automation looked like it would arrive sooner:

Famously, Goldman Sachs reduced the number of stock traders who process orders from large clients in its New York City headquarters from 600 to two. Similar cuts were made elsewhere in the financial world. Goldman now employs thousands of computer engineers, but a former executive estimated that the company “probably needed one programmer for every 10 of the old-school traders who lost their jobs”.

Other white-collar jobs that are repetitive, predictable, and involve large amounts of structured data are governed by similar dynamics. In addition to finance, this includes sectors such as accounting, law, insurance, information and communication, and scientific and technical services. It also includes government agencies.

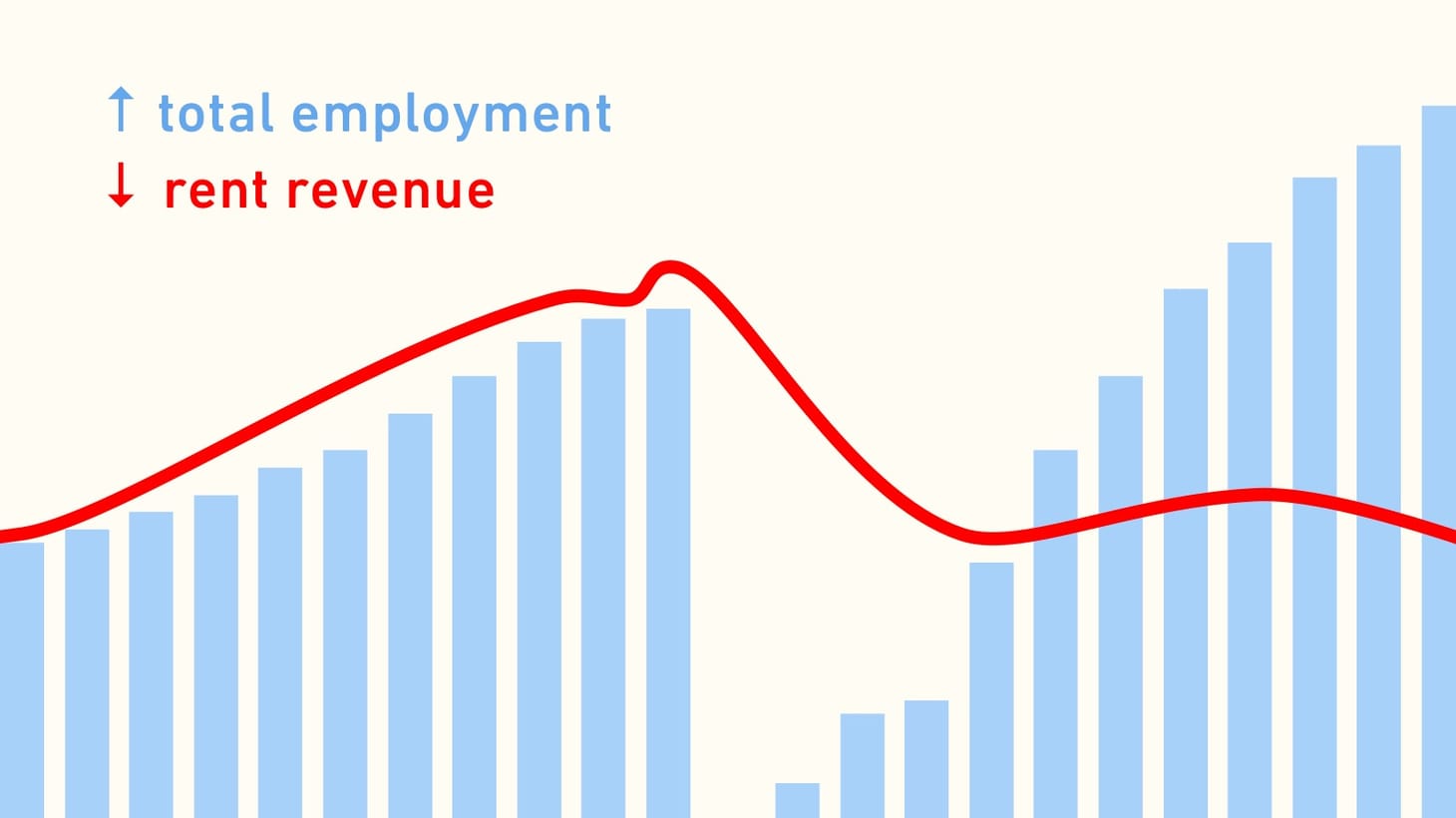

I expected this trend to intensify, leading to a breakup of the traditional relationship between job growth and office demand:

technological innovation might lead to dramatic growth in economic activity and corporate profits while simultaneously reducing overall demand for office space. It will also lead to the creation of new jobs, but these jobs will not require the same amount or type of office space...

Hundreds of studies have tried to estimate the timing and impact of AI. It is not clear which ones will ultimately prove right, if any. What is clear is that traditional models that predict demand for office space based on macroeco- nomic output need to be re-evaluated.

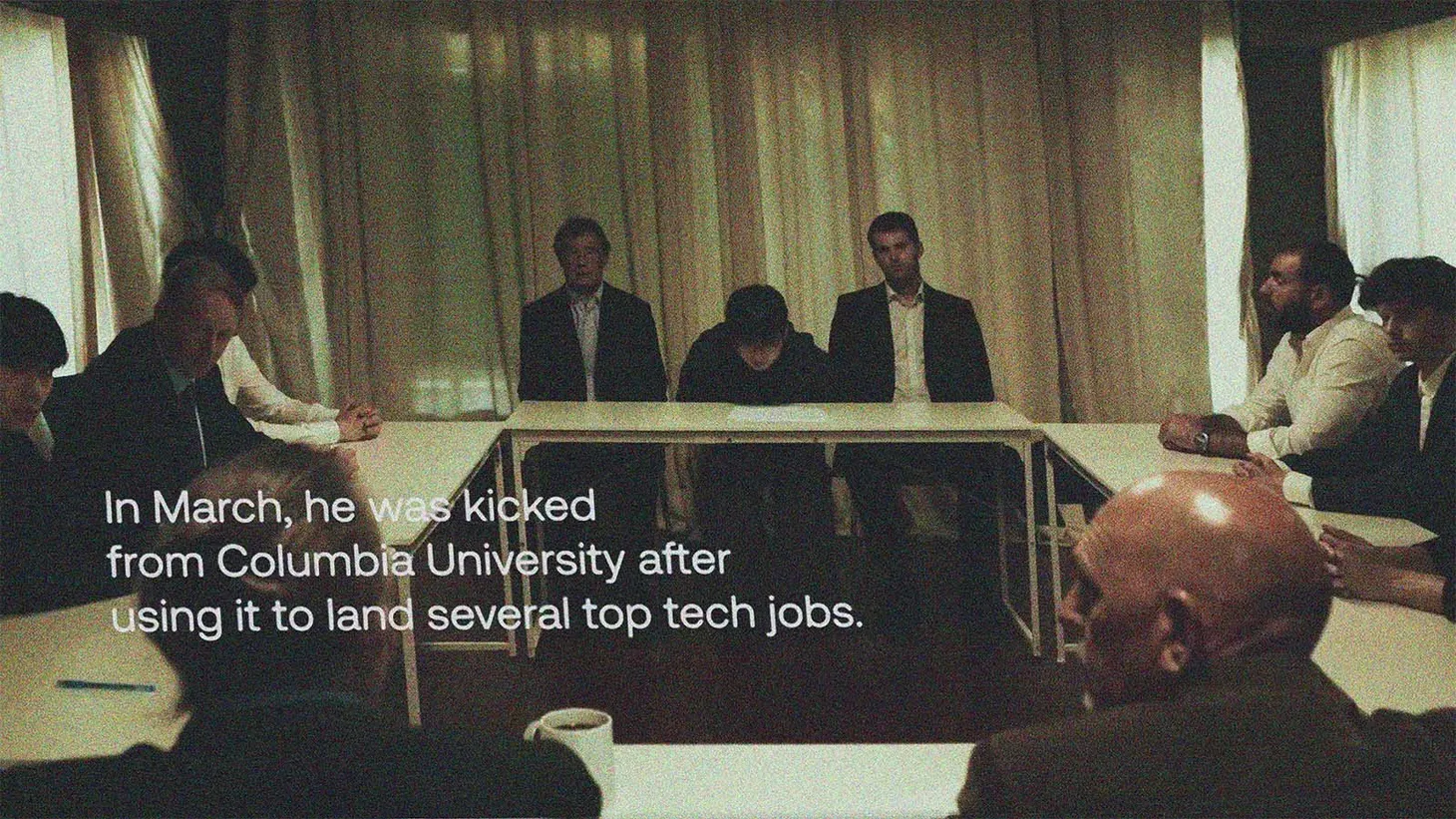

The good news is that the new wave of Artificial Intelligence breakthroughs has yet to make a significant dent in employment. The bad news is the impact of remote work has been expedited. Recent data from Moody's shows an apparent decoupling of total employment and office rents. Employment claimed to new highs following a trough in 2020. But office rent revenues continued to fall (dark blue-green line).

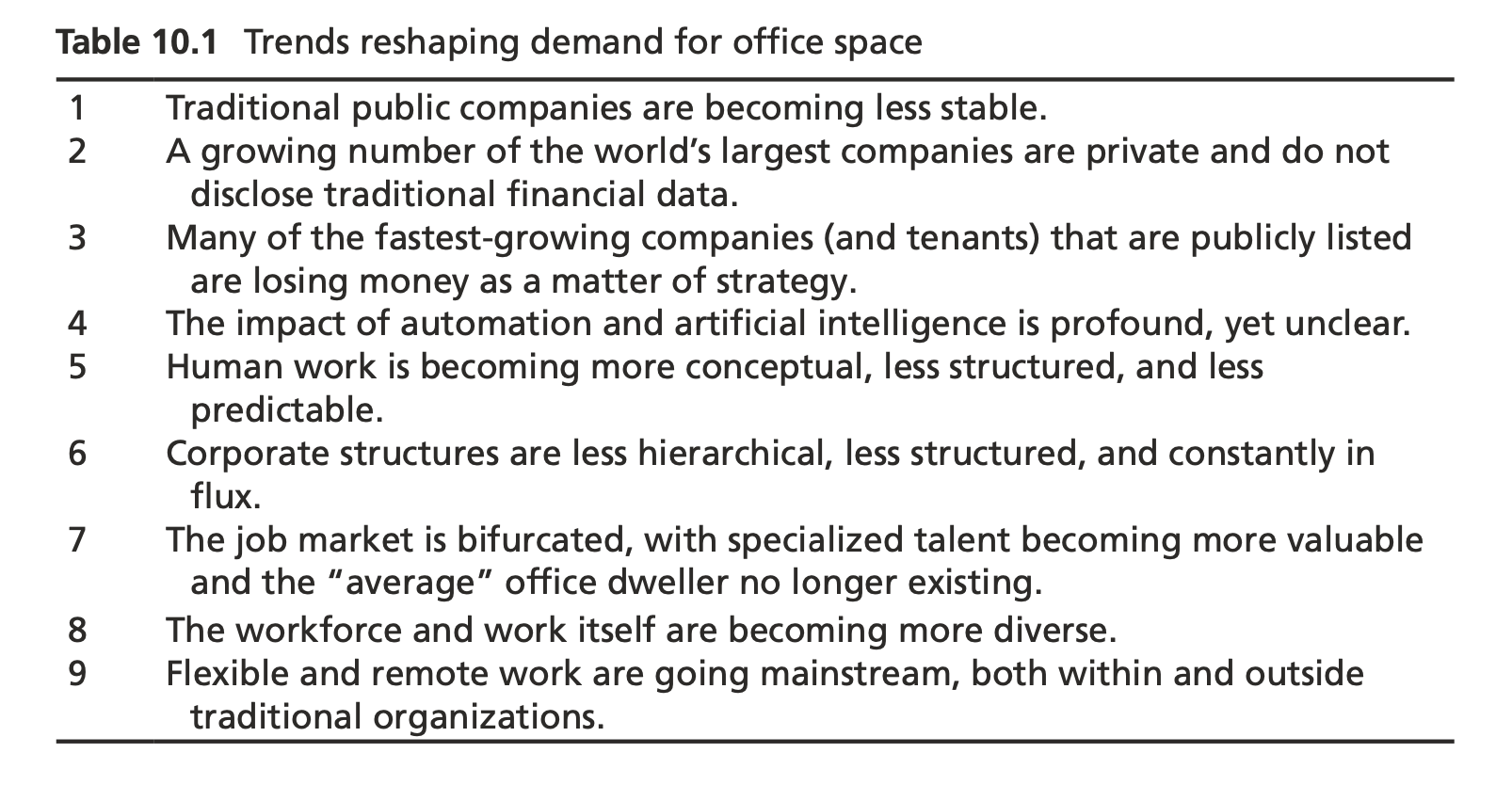

What does this mean for offices? Rent might ultimately recover, and the correlation with employment growth might strengthen, at least for a while. But the broken trust in the relationship will be hard to regain. Office buildings are rightly perceived as more risky, and their income less predictable. This would be true even if other economic indicators were positive and predictable. And in reality, many such indicators are becoming less predictable in themselves. We're not only seeing a weaker or negative correlation between office demand and corporate performance; we're also seeing corporate performance become less predictable and less transparent. The table below highlights some of the reasons for this shift.

Higher interest rates are currently pushing office valuations down as income is capitalized at lower multiples. This obscures a more fundamental shift in the nature of office income. Even if interest rates fall, office rents should be capitalized at a lower multiple to reflect higher volatility and uncertainty. The office market is becoming a negative-sum game, where overall value is depleted by outside forces (remote and AI), and participants must take something away from their competitors to maintain their current revenue, let alone grow it.

But there's also some good news. The game is negative-sum only if you focus on traditional rent. If you look at the broader picture, there are new revenue opportunities from services, tools, technology, and data. Many tenants will employ fewer people per unit of revenue, but this also means they'll be willing to spend more per employee. To capture this higher spending, landlords will have to offer new services and solutions that they aren't currently offering — flexibility, networks of spaces, community, and specialized facilities for various uses. In many cases, it won't be the landlords at all. New companies and brands will emerge to provide solutions employers need, with space as a mere input to new hospitality and service businesses.

Best,

Dror Poleg Newsletter

Join the newsletter to receive the latest updates in your inbox.