Betting the Firm

The company of the future will look like a venture fund, and talent will become a truly investable asset.

Corporate executives often say “employees are our greatest asset” or “we’re investing in talent.” This has always been true figuratively: people are important, and training them is worthwhile. But as talent becomes more important, people will literally become assets that organizations can invest in. In the process, these organizations will adopt new structures that look less like corporations and more like venture capital funds.

Alpha Bets

A key purpose of the modern corporation is to reduce uncertainty. Firms hire people and own resources to ensure that they will be available when needed. This approach compromises dynamism for the sake of efficiency and creativity for the sake of control: It helps to get known things done, and it ensures someone is always available to work.

This arrangement worked reasonably well in the industrial era when companies competed by using the same resources to produce the same things. The economic inputs (materials, labor) were easy to quantify, the economic outputs were reasonably easy to predict, efficiency was the key to winning.

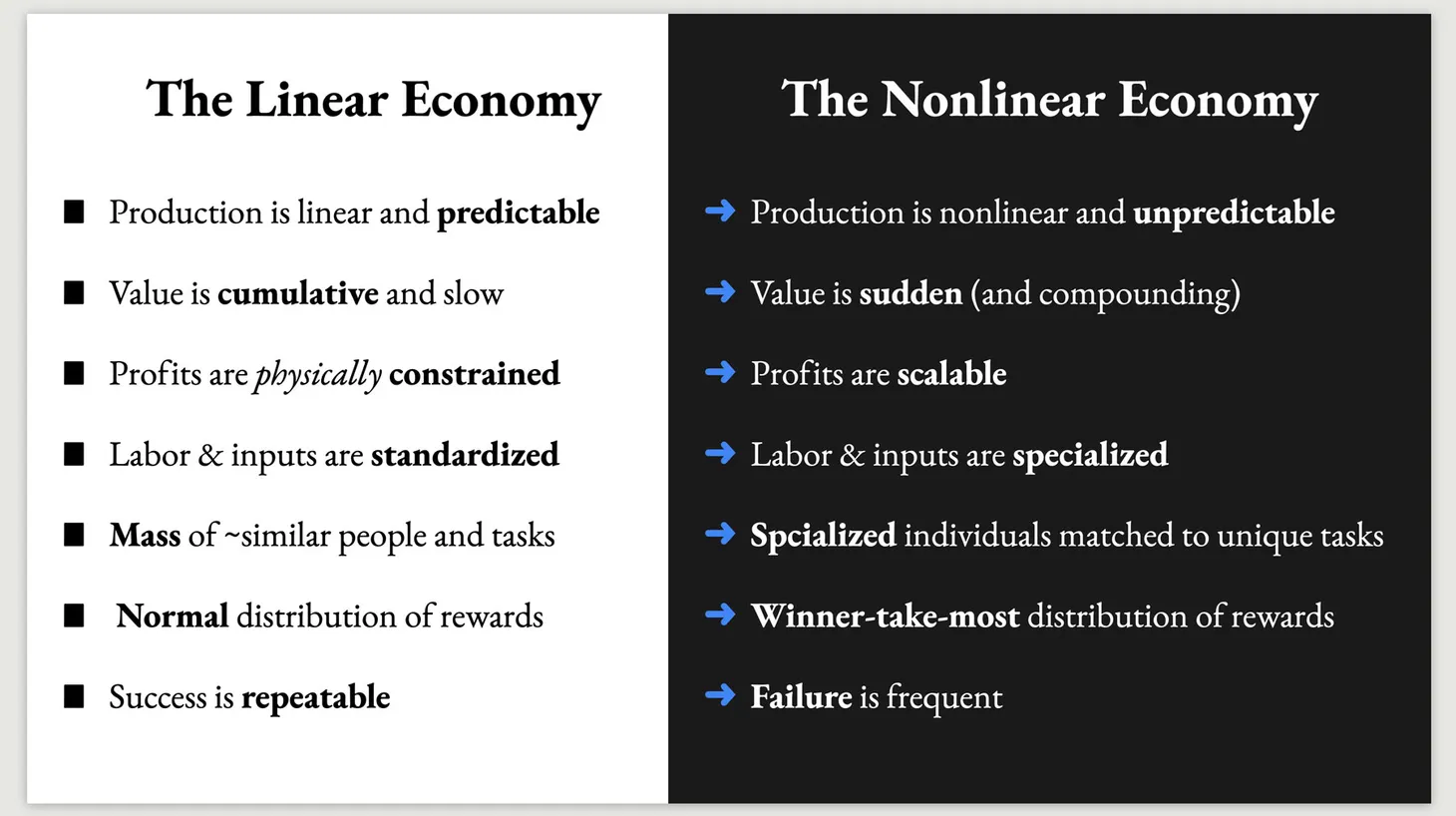

But in the 21st Century, the biggest challenge is not how to get things done more efficiently; instead, the challenge is figuring out what to do. And the relationship between economic inputs and outputs is no longer linear.

Consider the difference between early 20th Century Ford Motors and early 21st Century Google. Ford knew that adding an X number of employees and building Y more production lines could (reasonably) predictably produce and sell an additional Z number of cars.

But Google didn’t know that asking Paul Buchheit to tinker with email would end up producing Gmail or that hiring Krishna Bharat would ultimately lead to the invention and development of Google News. Hiring X more engineers and setting up Y more workstations would not necessarily increase the company’s revenue.

The world of Ford is the world of interchangeable employees working on clearly defined tasks. The world of Google is a world of specific employees working on loosely or undefined tasks.

But if you don’t know what to work on and don’t know which person is most likely to get it done, how do you allocate resources?

You make bets.

Hewlett Packard 2.0

One of the most important companies in the history of Silicon Valley was established to produce… nothing in particular. As Peter Sims points out, Bill Hewlett and Dave Packard set up shop in a one-car “without knowing what they would eventually produce; they just knew they wanted to work together and to build a great company.” They came up with various electrical devices and started to sell them.

Later, when HP was already a big company, the founders maintained their open-minded approach. The company innovated and grew by making what Hewlett called “small bets” on products and markets that didn’t exist yet. The company’s centralized management layer allocated people and resources between these bets to ensure the promising ones would continue to grow.

The HP way worked, at least for a long while. Between 1939 and 1999, it achieved an annual growth rate of 18%. The company represented the transition from the old industrial world into our own era — from the world of Ford Motor Company to the world of Google and others. HP was not the first company to try to come up with a new product, but its approach inspired other companies in the valley, including one founded by an HP intern named Steve Jobs.

HP officially dissolved in 2015, but its impact on the future is still unfolding. In a recent interview, Marc Andreessen used the term “HP 2.0” to describe his vision for A16Z, one of the world’s largest venture capital funds. Andreessen wants his venture firm to provide portfolio companies with all the services and resources that HP’s head office used to provide to its own divisions and bets: money, talent, government relations, PR support, marketing and distribution channels, and, more generally, “someone you can call” when you suddenly need something (and not just advice).

The convergence of corporations and venture funds is not just an amusing analogy. It points to a fundamental shift in the nature of business and employment.

A Majority of Minorities

The original HP was a corporation that behaved a bit like a venture fund: it made occasional bets. A16Z is a venture fund that wants to be more like a corporation: to build a relatively thick management layer that helps support its multiple portfolio companies and allocate resources between them.

Does this mean that in a few years, A16Z will look like HP in its prime? No. Unlike HP, A16Z does not make a handful of bets on projects it fully owns; instead, it makes hundreds of bets on ventures in which it owns a minority stake.

Is this the future of venture capital? Yes, at least partly. But it is also the future of corporations as a whole. The original HP was willing to compromise efficiency and control for the sake of more dynamism and creativity. Its founders were early to notice that the world was changing and innovation was becoming more important (for various reasons: globalization, demographics, the emergence of consumer culture, and more).

HP was willing to let go of some control over what its various divisions did, but it still maintained full ownership of them. The “little bets” were run in-house, which meant the number of bets was limited.

Now, A16Z is realizing that innovation is becoming even more important and that it’s becoming much harder to figure out what to build and who to build it with (for various reasons, notably the cheap cost of launching and distributing software, the abundance of speculative capital, the network-effects nature of many online businesses, and consumers’ increasingly complex preferences).

To succeed in such an environment, it’s no longer enough to make a handful of little bets on the side. Betting is becoming the main business, and an organization has to make hundreds of them in order to have a decent chance to succeed.

Of course, the word “organization” itself is less clear in this context: A16Z owns pieces of hundreds of independent companies, but it does not control any of them. In some sense, this is not an “organization” at all. But in another sense, this is a direct evolution of what HP originally set out to do, but at a much larger scale. When you make a handful of bets, it’s possible to maintain ownership of all of them, even if you give up some managerial control. But if you want to make hundreds of bets, you have to give up ownership as well.

But this approach only solves part of the equation. It increases the odds of betting on the right project or business idea. But how do you figure out which people are most likely to succeed in bringing it to life?

We cover this in part two.

Dror Poleg Newsletter

Join the newsletter to receive the latest updates in your inbox.