Keynote: Dror @ MIT

How the laws of show business are reshaping our cities, companies, and careers.

Why are San Francisco's offices empty during the biggest tech boom in history? How did Marriott become more valuable by owning fewer buildings? Why do tech companies pay some engineers 20 times more than others in the same role? How did ChatGPT reach 100 million users while established tech giants struggle to innovate? Why are companies with zero revenue getting billion-dollar valuations? And what does all this mean for your career in an economy where success looks more like Hollywood than Wall Street?

Earlier this week, I visited the Massachusetts Institute of Technology to give a guest lecture to graduate students hosted by James R. Scott at MIT's Real Estate Technology Hub.

The talk was "Eating the World: The Collision of Tangible and Intangible Assets." We explored the growing importance of software and stories, the similarities between WeWork and OpenAI, the good and bad career advice we received from our parents, the future of cities, how I met my wife, and more. A condensed recording of the talk is available below.

🎤 Are you looking for a keynote speaker for your next event, corporate offsite, or investor meeting? Every year, I inform and inspire thousands of executives across the world. Visit my speaker profile to learn more and get in touch with my team to enrich your next conference, offsite, or board meeting.

Enjoy the talk,

Below is an article from Claude.ai based on my talk.

When Ilya Sutskever left OpenAI to start a new venture, investors handed him a billion dollars before he even had a business plan. To some, this might seem like another example of tech industry excess – money chasing dreams rather than tangible assets. But as Dror Poleg argued in a recent MIT talk, this phenomenon reflects a deeper transformation in how value is created and distributed in our economy.

Consider Marriott International, a company approaching its centenary. Despite being synonymous with hotels, Marriott barely owns any buildings. Most of its value lies in intangible assets – its brand, systems, and know-how. When the company split its physical and intangible assets into separate entities, the intangible-focused Marriott International saw returns of 1500% over 25 years, while the real estate company managing the actual hotels managed just 18%.

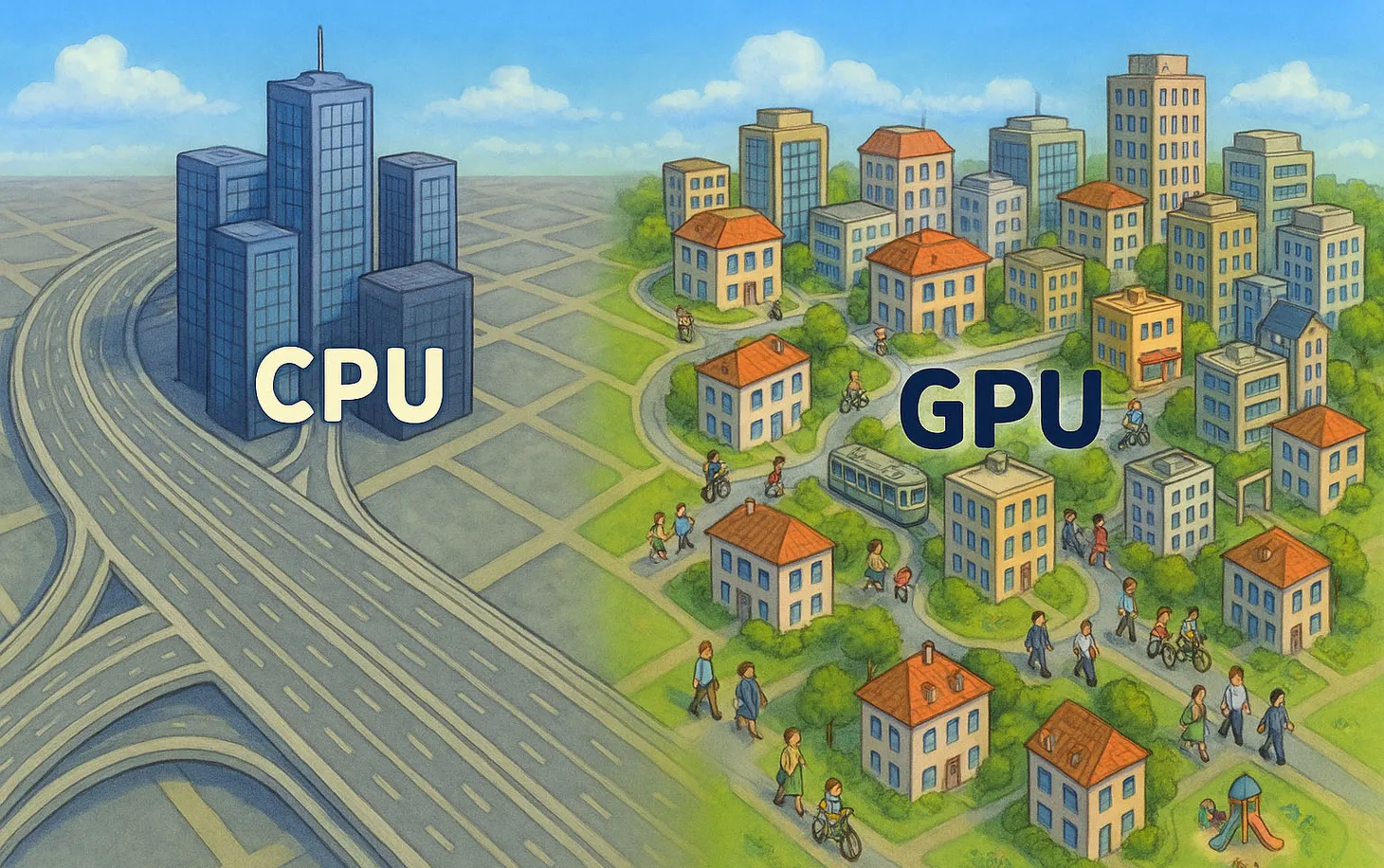

This isn't just a story about the tech industry eating the world. It's about a fundamental shift in how value is created across all sectors. Fifty years ago, the largest companies in the world primarily owned physical things – oil wells, factories, real estate. Today, over 90% of the value in S&P 500 companies comes from intangible assets. Even Apple, which still sells physical devices, now derives nearly half its revenue from services.

This shift is reshaping our cities in unexpected ways. When the internet first emerged, experts predicted the "death of distance" and the decline of cities. Instead, the opposite occurred – cities became more vital than ever as centers of innovation and creativity. But now we're seeing another twist: even as the AI boom makes San Francisco's tech companies more valuable than ever, its offices sit half-empty. The relationship between economic activity and physical space is breaking down.

The new economy, Poleg argues, looks less like a factory production line and more like Hollywood. Success is unpredictable and often binary – massive hits coexist with total failures, with little middle ground. Just as no one can reliably predict which movies will succeed, no one anticipated that ChatGPT would reach 100 million users faster than any product in history. Value appears suddenly and compounds dramatically, while traditional metrics of input and output become less relevant.

This has profound implications for how we think about real estate and urban development. Our cities were built for an industrial economy – one where masses of people worked similar jobs on similar schedules in predictable patterns. Our zoning laws, tax systems, and infrastructure all assume this kind of stability and uniformity. But that world is disappearing.

Instead, we're seeing the emergence of what Poleg calls a "nonlinear economy." Work is becoming more specialized and unpredictable. Success increasingly depends on matching exactly the right talent with the right opportunity at the right moment. Companies are discovering they can collaborate effectively across multiple locations, accessing global talent pools rather than requiring everyone to be in the same building.

Yet this doesn't mean physical space becomes irrelevant – rather, its role is changing. As some things become more abundant (like digital connection), others become scarce (like meaningful human interaction or specialized lifestyle experiences). The most successful real estate ventures are those that understand this new dynamic. Citizen M hotels, for instance, succeeds not by trying to be everything to everyone, but by catering specifically to solo travelers who want standardized, tech-enabled rooms in global cities.

The challenge ahead is to reimagine our built environment for this new reality. This isn't just about adding better WiFi or more flexible workspaces – it's about fundamentally rethinking how physical space can serve an economy where value is increasingly created through unpredictable, nonlinear processes.

The winners in this new world won't be those who simply own prime locations or build the tallest buildings. They'll be those who can navigate the collision between tangible and intangible value creation, understanding that in an age of digital abundance, physical spaces need to address new kinds of scarcity – whether that's human connection, specialized experiences, or the infrastructure needed to power our increasingly digital lives.

The implications extend far beyond real estate investment returns. How we adapt our physical world to this new economic reality will shape everything from economic opportunity to social connection. As Poleg suggests, the built environment wasn't just designed for a different economy – it was designed for a different society. Reimagining it for the age of intangible value is both a challenge and an opportunity to address some of our most pressing social issues.

🎤 Are you looking for a keynote speaker for your next event, corporate offsite, or investor meeting? Visit Dror's speaker profile to learn more and get in touch with the team to enrich your next conference, offsite, or board meeting.

Dror Poleg Newsletter

Join the newsletter to receive the latest updates in your inbox.