Can ‘We’ Work? Perspectives on WeWork’s IPO

WeWork combines an impressive trajectory with significant risk. Other public companies offer valuable insights about its business model, liabilities, governance, and valuation.

Welcome to the desert of the real. Jean Baudrillard coined the term in 1981 to describe a world in which reality is a derivative of its representation — a world in which the map is all there is and the territory itself is disintegrating. Baudrillard was grappling with the nature of consciousness in the time of hyperreality, when it is no longer possible to distinguish between what isand what seems.

In 1999, The Matrix introduced Baudrillard’s ideas into mainstream culture. In the film, Morpheus looks into Neo’s eyes and informs him that everything he is seeing and feeling is a “neural-interactive simulation”, generated by intelligent machines. The purpose of the simulation is to give humans the illusion of consciousness, the illusion that they are still living in “the world as it was at the end of the twentieth century”. Meanwhile, in the real world of 1999, the NASDAQ reached an all-time high, accelerating towards an inevitable crash.

In the real world of 2019, intelligent machines are yet to take over, but some are already looking to save human workers from the banality of daily life. The We Company (née WeWork), an operator of physical offices, announced that it is on a mission “to elevate the world’s consciousness”. To finance this mission, the company is seeking an initial public offering. The company’s last official valuation, $47 billion, left many people wondering whether WeWork’s investors live in an alternate reality, constructed by the company’s founders.

Do they?

Could the same thing happen to you?

This article offers perspective on the most glaring red flags in the We Company’s S-1. It uses other public companies to illustrate various points about We(Work)’s business model, liabilities, performance during a downturn, total addressable market, governance, and valuation. I wrote down the hard questions and tried to come up with the most compelling answers that will help keep the dream alive. In the process, I explore the future of the office market as a whole.

As Morpheus told Neo, this is your last chance to get off. After this there is no turning back. You close this browser, the article ends, you wake up in your old office building and believe whatever you want to believe. You keep reading, you stay in We-nderland, and I show you how deep the rabbit hole goes… 🐇

Is WeWork a real business?

IWG (née Regus) is the world’s largest operator of serviced offices. The company was established in 1989 and has been publicly listed on the London Stock Exchange since 2000. IWG is active in more cities than WeWork, has about 2,800 more locations, and leases more than double the amount of space. The company is profitable, growing, and trades at a multiple of more than 20x its earnings (profits). The multiple is generous considering the company’s historical growth rate. Its current valuation is around $4b.

IWG is proof that operating flexible workspaces can be a profitable business, at least during an economic expansion. It shows that public markets are willing to value companies in the sector at a generous multiple — assuming those companies actually turn a profit. In addition, IWG’s latest filings mention that the company has entered several franchise agreements, allowing building owners or other parties to use its brand, designs, and distribution platform.

If you think WeWork is somewhat similar to IWG, you also acknowledge that WeWork is a real business and not just an elaborate pyramid scheme, as some have suggested. We will revisit IWG later. On to the next question.

How do you reconcile the We Company’s immense liabilities?

WeWork enters long-term obligations with its suppliers while it only relies on short-term commitments from its customers. If WeWork is unable to recruit enough customers, it remains at the mercy of its landlords.

This is a cause for concern. But the simple formulation above understates the inherent risks of other “as-a-service” businesses, and overstates the power of landlords, particularly during an economic downturn.

Exhibit one is Amazon Web Services (AWS), Amazon’s most profitable business unit. Earlier this year, I wrote about the similarities between AWS and the future of office space. Earlier this week, Ben Thompson drew the same analogy while evaluating the bull case for WeWork. Both pieces are worth reading. In this article, our focus is on the bearcase for AWS.

Amazon Web Services allows companies to access sophisticated computing resources and “pay for capacity by the hour without any long-term commitments or upfront payments.” Amazon’s 2018 annual report states that AWS occupies over 14 million square feet of data and service centers, most of them leased. This is about the same amount of space that WeWork occupied a year or so ago.

We assume the rent at those industrial properties is much lower than the rent WeWork pays for urban office buildings. At the same time, we assume that AWS locations require a much higher upfront investment in equipment and infrastructure. Against these massive long-term obligations stand the short-term or flexible commitments from AWS’s millions of customers — startups, large tech companies, government entities, and non-profits.

AWS’s margins give it significant room to maneuver in case of a downturn. For the purpose of our discussion, it suffices to note that building a business based on term arbitrage is not in itself a red flag. Particularly when the business offers clear benefits and a delightful experience that augments or exceeds the value of mere arbitrage. AWS is not simply “less risky than setting up my own server”; it offers customers a level of convenience, service, and sophistication that is near-impossible to replicate without gargantuan scale. Some flexible office companies don’t offer much more than “less risky than signing a lease”. WeWork is not one of them.

Exhibit two is Starbucks. The company signs long-term leases for thousands of locations and relies on the willingness of tens of millions of customers to continue to buy coffee each day. What happens if they stop? Why can’t someone just show up and open a coffee shop? That’s where Starbucks’s brand, loyalty program, digital tools, scale, and other strengths come into play.

But even Starbucks is not fail-proof, and its failures are even more instructive than its successes. In 2017, Starbucks announced plans to shut down all 379 stores of Teavana, a tea brand it acquired in 2012. Some bets don’t pan out. It was brave of Starbucks to cut its losses and walk away. But what about the leases for all of those stores? 77 of them were at malls that were owned and operated by Simon Properties, the world’s largest and most powerful retail landlord.

Simon sued Starbucks to enforce the terms of its leases. Did it succeed? The two companies ultimately “settled” the matter outside of court. Teavana shut down and everyone moved on with their lives. Obligations on paper are meaningful, but they are notunavoidable. Simon has much more power in the retail world than any landlord has in the office world. It was still forced to renegotiate when an important tenant reneged on its obligations.

Which brings us to exhibit three: Landlords. Land-lord. The word itself inspires envy and awe. Landlords own the soil from which all other businesses grow. Or do they? Let’s look at an office landlord of comparable size to WeWork. Vornado Realty Trust is a REIT listed on the New York Stock Exchange. As of December 2018, Vornado owned all or portions of 21.5 million square feet of Manhattan office space, as well as various other properties. Vornado’s market cap is around $11.5b. The company’s balance sheet includes about $7.5b in mortgages and other property-related debt.

Landlords are rarely in control of their own destiny. The properties they “own” serve as security for mortgages and other debt. When landlords fail to meet their obligations, lenders can take over a property or force its sale to a third party. During the last downturn, Vornado’s market capitalization took a 75% dive. Many other REITs and landlords faced similar turbulence. Some of them didn’t make iy. The assets survived, but the owners changed.

When the next downturn arrives, WeWork may very well be in a position to renegotiate many of its leases. For most owners, a crisis is not a great time to lose a major tenant. This does not mean WeWork is safe. In a crisis, owners are often forced to sell to other, better capitalized investors. Once these investors take over, they might be in a better position to force WeWork and other tenants to meet their obligations. But for new investors looking to reposition struggling assets, WeWork might be part of the solution and not part of the problem. More on this below.

Ok, maybe WeWork can survive. But can it thrive?

Before we dive deeper into the crisis scenario, we need to agree on one thing: Commercial real estate is becoming a consumer industry. The focus is shifting towards the needs and aspirations of individual end users. We’re not talking about freelancers and startups. In the largest real estate markets, the largest and fastest growing employers are engaged in a bitter war for talent. The office is a key weapon in this war.

Further, the most innovative companies are no longer looking for an office space; they are looking for a solution that would enable them to attract and retain the best people and empower these people to produce their best work. Increasingly, this solutionentails access to a variety of adjacent and distributed spaces. It involves access to other services. And it involves access to people and ideas.

Many landlords (and lenders) haven’t gotten the memo yet, but office tenants have. In the markets that matter, fewer and fewer companies — large or small — are interested in the old arrangement of signing a long-term lease for an empty box and then spending months supervising contractors and consultants. Small companies can’t even contemplate signing a “proper” lease. And even large companies are shifting more of their real estate budget towards space-as-a-service (SPaaS) providers. WeWork is already drawing 40% of its revenue from companies with 500 or more employees, and this segment is growing faster than any other.

Am I exaggerating? Consider that SPaaS operators took up about 30% of all new office leases in NYC over the past couple of years. A similar dynamic exists in other key markets. A third of all available space is shifting to a different operating model. JLL predicts that by 2030, about 30% of alloffice space will be operated in a flexible manner. This shift is driven by the changing nature of work, the growing instability of corporate life, and the rising expectations of consumers who are used to receive everything on-demand.

WeWork and others are filling a gap between what landlords offer and what tenants want. SPaaS operators are not necessarily out to replace landlords, but they are becoming critical components of quality office buildings. For a simple analogy, consider the role played by Marriott and other franchisors in the lodging market. Hotel assets often involve 3 separate companies: An owner, a manager, and a brand franchise. In simple terms, the owner owns, the manger takes care of running the asset, and the brand takes care of attracting and serving the customers.

A crisis will accelerate the transformation of the office market. If tenants sign any leases at all, these leases will entail lower commitments, higher density, lower capital expenditures — exactly what SPaaS companies offer. Forget about freelancers. It is the large tenants that will flock to SPaaS once the economy sputters. Everyone will take a hit. Many landlords and many SPaaS operators will not make it to the other side. But in the morning after the crisis, the office market will be more flexible, more serviced, and more branded than it has ever been.

Who will drive this change? Those who will have plenty of cash once the market bottoms. Will WeWork have plenty of cash? Probably not. Who will? Some of the world’s largest institutional investors: private equity funds, pension funds, endowments. These investors already own more real estate than anyone but they normally do so in partnership with partners with the companies most of us call “landlords”.

Private equity funds are currently sitting on more “dry powder” — investment capital that is yet to be deployed — than ever. We mean this literally: there is more investor cash sitting on the sidelines today than at any other point in history. Hundreds of billions of dollars are waiting for an opportunity to scoop up and reposition real estate assets.

What if, instead of bringing along a “landlord”, these investors would choose to bring along WeWork to help them reposition and manage those newly-acquired assets? WeWork will not have to buy the building, and it would not have to lease it either. Investors would buy it, WeWork will operate it (or part of it), and they’ll share the profits.

It already happened. WeWork partnered with Nuveen (TIAA) and PFS, the money managers for two of the world’s largest pension funds, to acquire Devonshire Square in London. Meanwhile, Ivanhoe Cambridge, the real estate investment arm of another huge pension fund, is an investor in ARK, WeWork’s $2.9b property acquisition platform. Pension funds always have new money to invest and they are always looking for yield, especially in our zero-interest world. When a crisis hits and opportunities abound, WeWork could expand its existing relationships to bring more space under its operating umbrella. We are not saying it will happen, but it is feasible.

Even if it manages to keep growing, is WeWork a tech company?

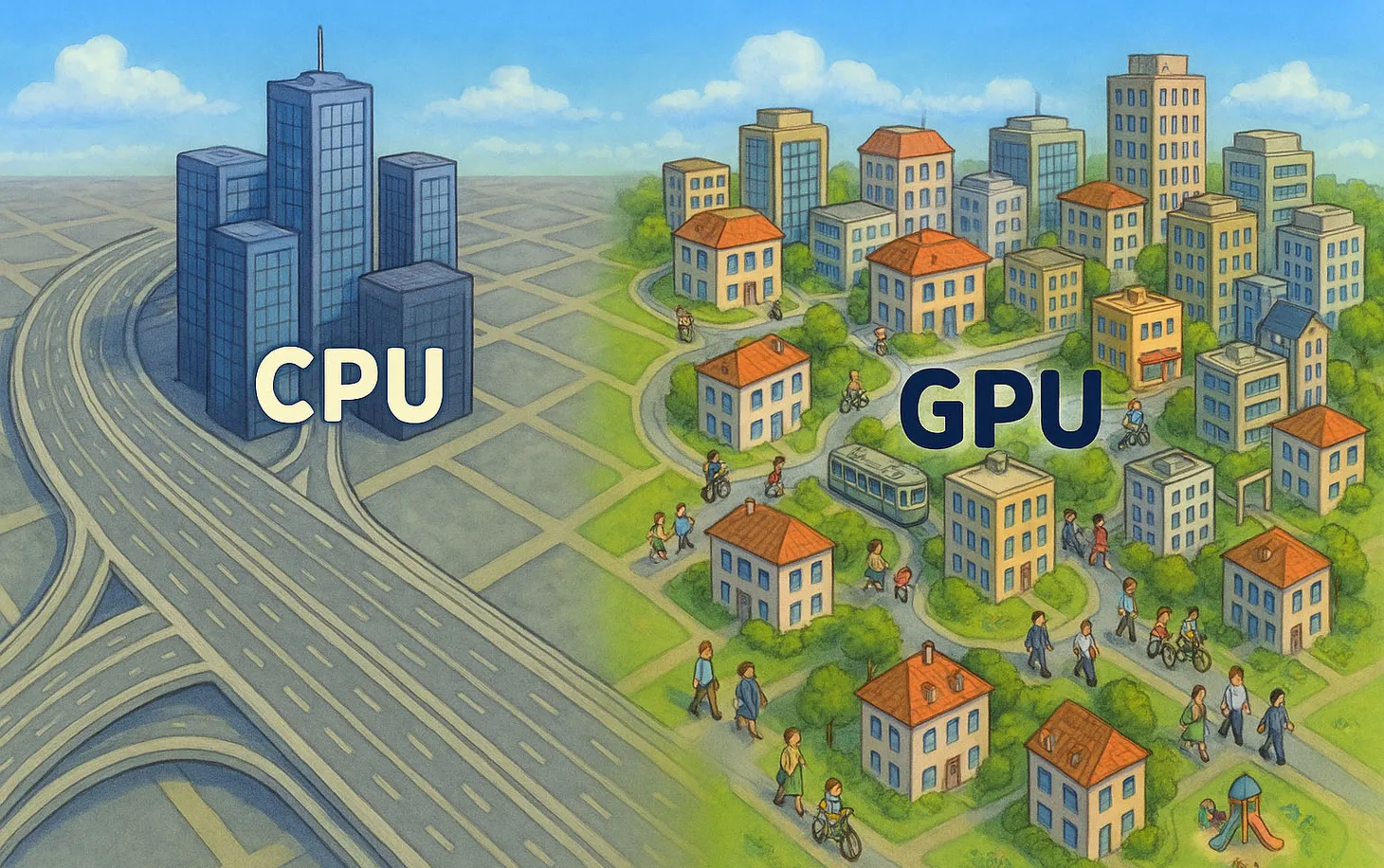

Let’s first define the meaning of a “tech company”. As Ben Thompson points out, a key characteristic of the economics of tech is the ability to turn high upfront investments in R&D into products that can be sold at low marginal costs. For example, Microsoft can spend $1b on a new version of Word, but once Word goes on sale, Microsoft enjoys a very low cost of delivering the software to every new customer. If 100,000 or 100 million people use Word, the cost to Microsoft is (almost) the same.

In contrast, a company that sells shoes needs to manufacture an extra pair of shoes for each new customer. More sales equal more production costs. Likewise, a landlord that sells space can only fit a limited number of tenants within each building. More customers need more space, which means more construction and more operating costs.

WeWork is not a tech company, but it made (and is making) significant upfront investments in “products” that give it an opportunity to lower the marginal cost of serving every additional customer. WeWork owes this opportunity to the unique nature of real estate. Ironically, real estate assets are so heavy that they can become incredibly light, at least as far as finance and accounting our concerned.

When, say, Nike needs cash to finance its inventory, that cash is relatively expensive. You can’t get a cheap mortgage for a heap of shoeboxes. But you canget a mortgage for an office building, and in some cases, you can even get a mortgage for your interest in a long-term lease. In addition to banks, there are plenty of private investors who are happy to extend equity or debt financing for quality real estate assets. Such debt and equity are often much cheaper than venture capital or traditional business loans. They are cheaper because they are secured by a real asset.

All landlords benefit from access to real estate lenders. But WeWork is in a position to spend even less on its real estate inventory by relying on the landlords themselves. To do so, WeWork will have to find landlords and who are willing to let it operate whole buildings without requiring it to sign a lease in exchange for a share of its operating profits. Is that possible? Yes.

Marriott is the world’s largest hotel operator. As of December 2018, the company’s various brands graced the facades of 7,000 or so buildings across the world. Marriott generated $2.36b in operating income from these buildings. But it only owned (or leased) 1% of them. All the other buildings were operated as franchises or through other revenue-sharing agreements.

Can a similar company exist in the office market? Yes. We mentioned above that even IWG managed to secure a few franchise agreements, and that’s without building a solid consumer brand or a unique physical product. We also mentioned above that WeWork is already creating partnerships to manage properties on behalf of some of the world’s largest property investors.

Marriott previously owned or leased a much higher percentage of its properties. But in the 1990s it split into two entities: Marriot International to manage the brand and hotel operations business, and Host Hotels and Resorts to handle property ownership and development. The two companies are still publicly traded, Marriot as a corporation and Host as a REIT.

WeWork is already experimenting with various financial structures to enable it to do something similar. And it is positioned better than anyone to become the Marriott of the office market —a market that’s well over ten times larger than hotels. Note that we haven’t mentioned any actual technological breakthroughs that WeWork may come up with. These would be a bonus. We do not expect WeWork to reinvent anything. Making good use of available technology is enough to put it ahead of 99.9% of traditional office operators.

IWG and Marriott achieve around 7% and 11% in operating margins, respectively. IWG is doing so with a brand portfolio that desperately needs a refresh, with dated sales processes, and with operations that spread across thousands of cities. Marriott does so in the face of intense competition from other powerful hotel corporations and online travel agents. What prevents WeWork from one day achieving better margins? Future competition.

What’s stopping landlords (or anyone) from doing it themselves?

Landlords will struggle to replicate WeWork for three main reasons: They don’t want to, they can’t afford to, and they probably shouldn’t try to.

Many landlords still think WeWork is a fad, a thing that will go away or remain contained in a narrow niche. They see WeWork as a newer version of IWG, a company that has been living in a far-away corner of the real estate market for 30 years without threatening anyone.

You can’t blame them. When landlords look at traditional metrics, their business looks better than ever. Rent is close to an all-time high, vacancy is low. But digging beneath the surface reveals a troubling reality. As we mentioned above, a huge percentage of new leases are signed with SPaaS companies such as WeWork. Thesecompanies sign long leases and pay landlords market or above-market rent. By doing so, they isolate landlords from what’s actually happening in the market: insatiable demand for flexible, branded, and serviced space.

Landlords who wish to compete directly with WeWork find that it is harder than it looks. First, landlords have far less capital than people assume. Billions of real estate assets come with billions of real estate debt that needs to be serviced. Most of the cash that’s left after that needs to be distributed back to shareholders (in the case of REITs) or Limited Partners (in the case of private equity real estate). The money that canbe reinvested is often restricted by a narrow mandate that only allows these entities to acquire or renovate real estate assets —as opposed to investing in proprietary software, building consumer brands, or developing proprietary distribution channels.

Some landlords are responding by partnering with other SPaaS companies such as Industrious and Breather. Some are investing directly into operators such as The Office Group and Convene. Some landlords have even launched their own coworking brands. All of these efforts are worthy, but they are modest in the context of the industry’s size. If and when landlords try to truly offer SPaaS at scale, they might run into additional challenges.

Which is why they probably shouldn’t try to be both property owner andSPaaS companies at the same time. As we have seen above, Marriott and other hotel companies ultimately split their property ownership activities and hospitality business into separate entities. These entities have different balance sheets, different financial targets, different executive teams, different strategies, and different funding sources.

WeWork is temporarily combining its property and hospitality businesses because it has no choice. Marriott has the power to get landlords to design buildings in a way that suits its brand, and to appoint property managers that meet its standards. WeWork does not have such power yet. But with time, it might. And a crisis might help expedite this process.

Even if I believe all this, what about all them Adam Neumann shenanigans?

The We Company’s S-1 highlights troubling governance issues and internal dealings. These alone would be a good reason not to invest in the company.

The only perspective we can provide is that other fast-growth companies have comparable governance issues. Google opted for a direct listing and its founders maintain control of the company even when other investors may control a majority of the shares. Facebook adopted a structure that grants superpowers to its founder and CEO and makes it difficult to remove him. And Twitter has a CEO that also serves as the CEO of another public company, Square Inc.

We do not say this to excuse Adam Neumann’s behavior, only to show that public markets might perceive things a little differently than media commentators and commenters.

Alright, so how much is it worth?

In a world of cheap capital and low yields, in which Uber is trading at a valuation of nearly $60b and Airbnb is valued by private investors at $35b, investors seem hungry for growth stories. WeWork is often seen as inferior to Uber and Airbnb since it is not enough of a technology company and it has massive long-term obligations.

But cracks are starting to appear in Uber and Airbnb’s growth and profit potential. Uber’s rise was expected to culminate in a “winner takes all” land grab of urban mobility. But it still faces multiple competitors and is grappling with disloyal customers and drivers. In essence, the company’s original business does not seem like it can ever make money. The company still has potential to make money from adjacent businesses such as food delivery, bicycles and scooters, and — one day — a fleet of autonomous cars. But these business are yet to materialize.

Airbnb seems like a healthier business. The company even turned a profit in 2017 and 2018, aheadof becoming a public company. But Airbnb is facing fierce competition from online travel agents and hotel brands who decided to enter the home-sharing market. Its growth avenues seem increasingly similar to those of its competitors (adding hotel listings) or speculative (partnering with real estate developers or experimenting with modular construction).

This is not meant to disparage either Uber or Airbnb, only to show the obstacles they face on the path to justifying their valuations — and to highlight the fact that public and private investors are betting that they will.

In contrast, WeWork’s model is much simpler and it is easier to imagine how the company would one day make a reasonable profit on its growing revenue. It does not mean that it will — it only means that making money from serviced real estate is far less far-fetched than waiting for self-driving cars or fending off Expedia and Booking Inc.

Both Uber and Airbnb’s suppliers — as well as customers — can easily move to a competitor whenever they like. In that context, building a business around immovable, expensive inventory might not be such a bad idea after all. Especially if you can ultimately both control it for the long term and get other people to finance it.

Still, $47 billion seems like a lot of money at this point. Public valuations are beyond the scope of my expertise, but my gut feeling is that the company would do well to aim for less than half of its latest valuation and grow from there. I believe it can.

Dror Poleg Newsletter

Join the newsletter to receive the latest updates in your inbox.