Farewell to We: What's next for WeWork?

Below are some notes I scribbled ahead of a media interview. Sharing here for those interested. Check out my upcoming book on technology's impact on real estate!

Where to next for the shared workspace firm?

Time to say goodbye to “We”, the company that aims to encompass its members' whole lives. Instead, back to WeWORK, a company that provides office space-as-a-service, at a competitive price, in great locations, with streamlined processes and great customer service.

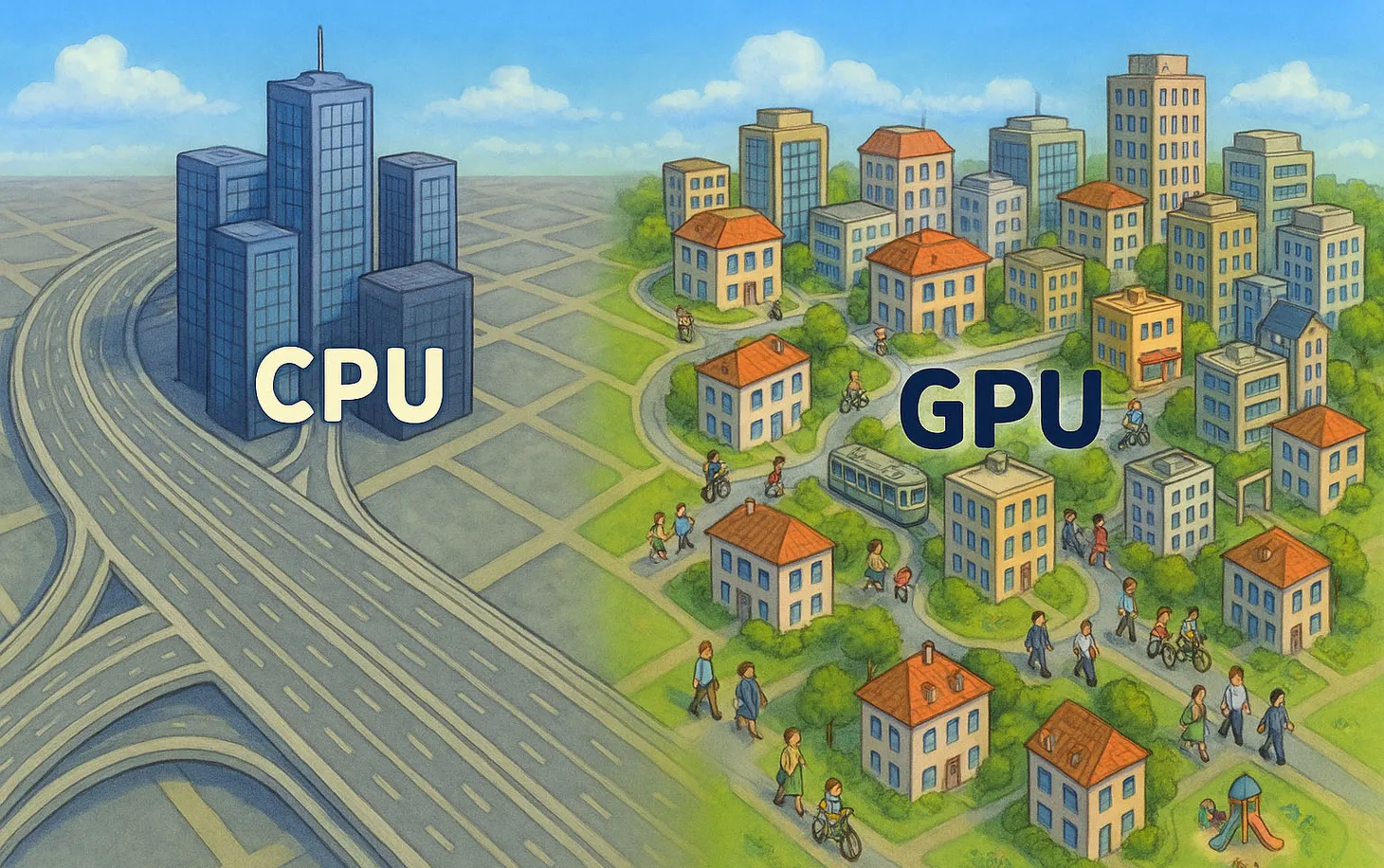

On the financial and operational front, that means shedding all non-core businesses and activities, cutting headcount, and doubling down on anything that can be automated or streamlined. While WeWork is not a tech company, it does make great use of multiple tools and processes that give it an advantage over competitors. And scale DOES matter in the flex office world, for both operations and distribution.

What does it need to do before returning to the capital markets, as promised by the new co-CEOs?

Clear up all the distractions. There is no need to “elevate the world’s consciousness” (to quote the company’s S-1). It’s enough to be an excellent operator of private and shared office spaces across the world.

Specifically, the company will have to:

- Prove that its unit economics work and that individual locations can generate 15-30% in contribution margin

- Strike a balance between growth and profitability; not necessarily become profitable, but show that it can

- Address some of the issues that were absent from the original S-1, particularly how often do locations need to be renovated and what Capex that would entail

- Show additional growth in revenue from large corporate clients that make longer commitments for larger spaces; 60% of total revenue should come from such clients

- Show progress on expansion that does not require the company to sign leases. This can mean revenue-sharing deals with landlords, franchise deals, management deals with enterprise customers (Powered by We), or partnerships with investors who buy assets for WeWork to operate.

How the business model would fare if faced with an economic slowdown?

It’s going to be tough. But if the company will become leaner and derive most of its revenue from large corporate clients, it can weather the storm. In addition, a crisis presents an opportunity for WeWork to partner with investors to take on and reposition additional office buildings. In the morning after the crisis, the office market will be more flexible, more branded, and more serviced. Someone will benefit. WeWork still stands a reasonable chance, but there’s a lot of work to do — and not a lot of time left to prepare.

Cover photo by Jan Tinneberg on Unsplash

Dror Poleg Newsletter

Join the newsletter to receive the latest updates in your inbox.