Global Money, Global War

A crowd with a bank account meets an army with an overdraft.

🚀 Looking for a Corporate Crypto Course? Give your team a hands-on introduction to Blockchains, Decentralized Finance, and Web3 with our private corporate cohorts. Learn more here.

This is the second issue of Hype Free, a newsletter about the future of the internet and digital assets.

Each week, it will provide concise and impartial analysis on the latest news about Decentralized Finance, DAOs, NFTs, the Metaverse, and other new ways in which people work, create, and invest online.

This week, I focus on a single topic. I am sending this email to subscribers to my personal newsletter as well as to Hype-Free subscribers, and to anyone who expressed interest in my course.

If you're not yet a subscriber, drop your email here. Over the next few weeks, the Hype-Free newsletter will get its own separate website.

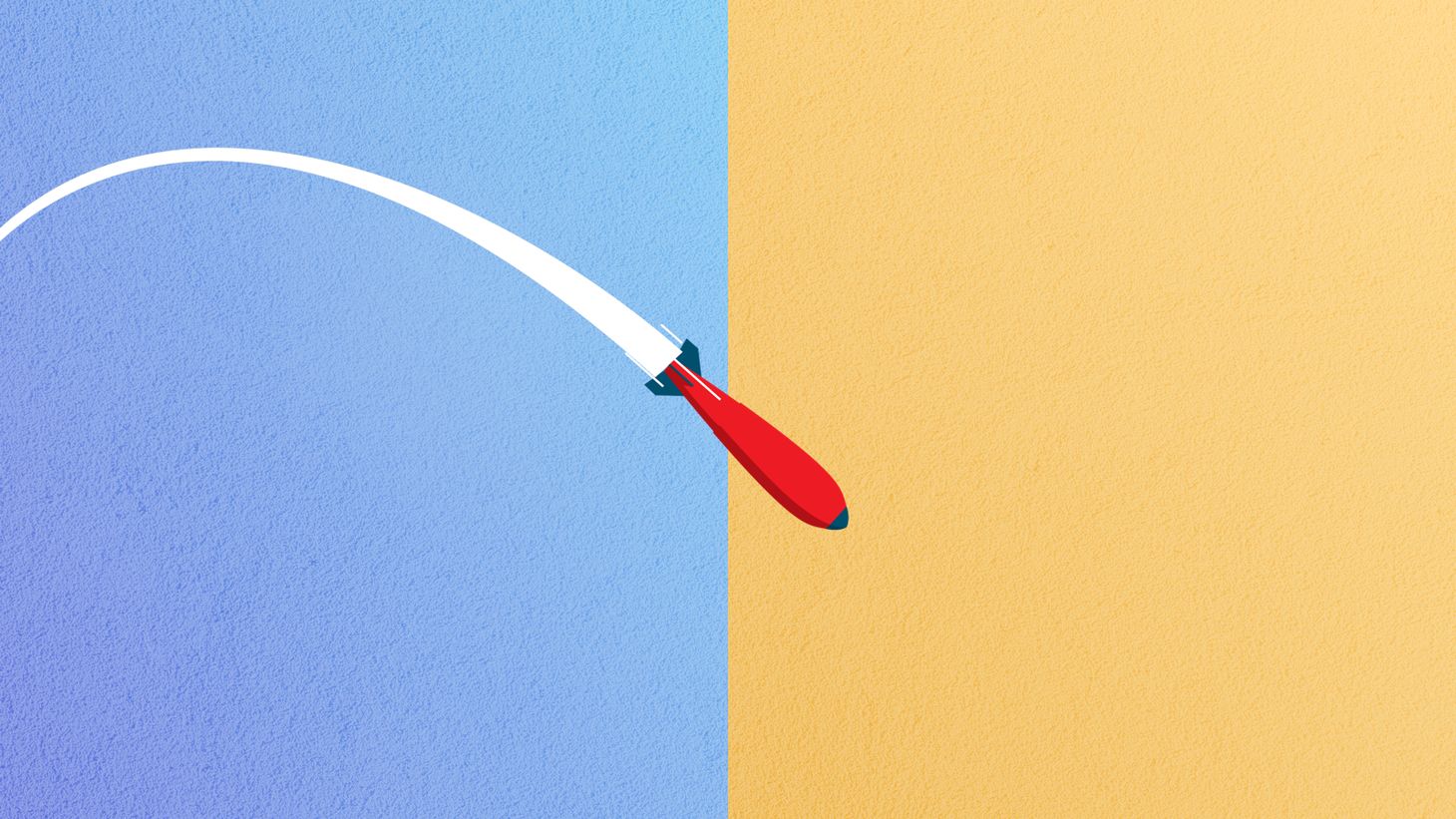

💸 Money without borders fuels wars without end? Monetary history is being written in front of our eyes. The consequences are unclear. The EU, UK, US, and other allies took the unprecedented steps of locking some Russian banks out of the SWIFT messaging system and freezing some of the Russian Central Bank's foreign currency assets.

As the FT reports, these efforts "block Russia's ability to access roughly $630bn in foreign reserves and impose huge costs on its economy." They are already sparking a bank run within Russia — with citizens looking to withdraw or exchange their Rubles and get them out of local banks.

If there is such a thing as an economic nuclear bomb — this is it. Putin deserves to be punished, but the consequences of such monetary actions will likely reverberate well beyond the Ukraine-Russia conflict.

When the US-led financial order locks out countries arbitrarily, this creates opportunities for alternative systems. An obvious candidate is China, which can step up and encourage more countries to hold and use the Yuan for international trade and as a reserve.

But China has its own problems, and it is limiting the ability of its own citizens to exchange the Yuan into other currencies and move it out of the country. To become a global reserve currency in the traditional sense, the Yuan must be freed of these constraints. In other words, if China wants to have more power over the global financial system, it needs to forfeit some of the power it holds over its own citizens.

But there's an alternative.

China has been experimenting with a new digital currency or Central-Bank Digital Currency (CBDC). The digital Yuan aims to replace all of the coins and notes currently in circulation and replace them with a digital representation. The digital Yuan has a dual purpose:

1. To give the government total control over how money is being used, including the power to freeze certain transactions remotely or "program" coins to only work in certain situations or specific times.

2. To make it easier for people worldwide to use the Yuan for cross-border transactions.

In theory, a programmable global currency would enable China to achieve two goals that would be incompatible with traditional Money: Have more control over its own population and make its currency more useful for global trade.

While the digital Yuan was inspired by cryptocurrencies such as Bitcoin and Ethereum, the digital Yuan aims to achieve precisely the opposite goal: centralize the power of Government and spread over a more significant chunk of the global economy.

But China's monetary system is not the only one with the opportunity to benefit from recent events. Regardless of whether it was justified, the arbitrary financial "bomb" the West has dropped on China highlighted the need for a financial system that operates based on pre-defined rules rather than the whims of this or that Government. This is precisely the type of system that cryptocurrencies such as Bitcoin and Ethereum aspire to provide.

Bitcoin and Ethereum have also proven to be functional as facilitating large payments across borders: More than $20 million in donations have been transferred to the Ukrainian Government and related entities by supporters across the globe. Many of these supporters were moved by videos and memes on social media.

This ties back into an idea I've been writing about before the war began (here and here): Crowds of people will join forces to manipulate the market for financial products and ideas. Memes will play a growing role in determining which groups win.

The support garnered by Ukraine shows this process in action. It's heartening in some ways and terrifying in others. When a bunch of excited (or bored) people on Twitter can finance weapons purchases for armies on the other side of the world, it's clear we've entered uncharted territory.

What did I miss?

What else happened this week that I should write about? Reply to this email to let me know.

Do you know anyone who'll enjoy this newsletter? Let them know! If you enjoyed this newsletter, please subscribe.

Dror Poleg Newsletter

Join the newsletter to receive the latest updates in your inbox.