No Rent: Real Estate’s New Business Models

Emerging technologies will enable operators to monetize physical space in new and creative ways.

Every day, each of us visits dozens of web sites and apps to access information and use various tools for work, communication, and fun. Most of these sites and apps are free. Online business models allow developers to monetize their traffic without charging customers directly. They are made possible by data collection, complex analytics, and ecosystems that allow different providers to share and create value over time.

Technology now makes it possible to apply similar data collection and analytics to physical spaces. This will lead to the emergence of new real estate business models that do not rely on traditional rental income. Here’s how.

Site Visits

Imagine having free access to a private space where you can spend hours working, socializing, taking a break, or playing with friends. Imagine doing that every day, for many years, across many different locations, without having to pay anyone. Imagine getting what you need from any given site and letting somebody else worry about the cost of development, maintenance, and security.

Imagine, on the other hand, the true cost of spending all your time in a space that you don’t own or control, under the surveillance of entities you never formally chose to transact with, exposed to commercial offers that you wish you could avoid, and governed by a legal agreement that you’ve never read. This is how the internet works.

Time is Money

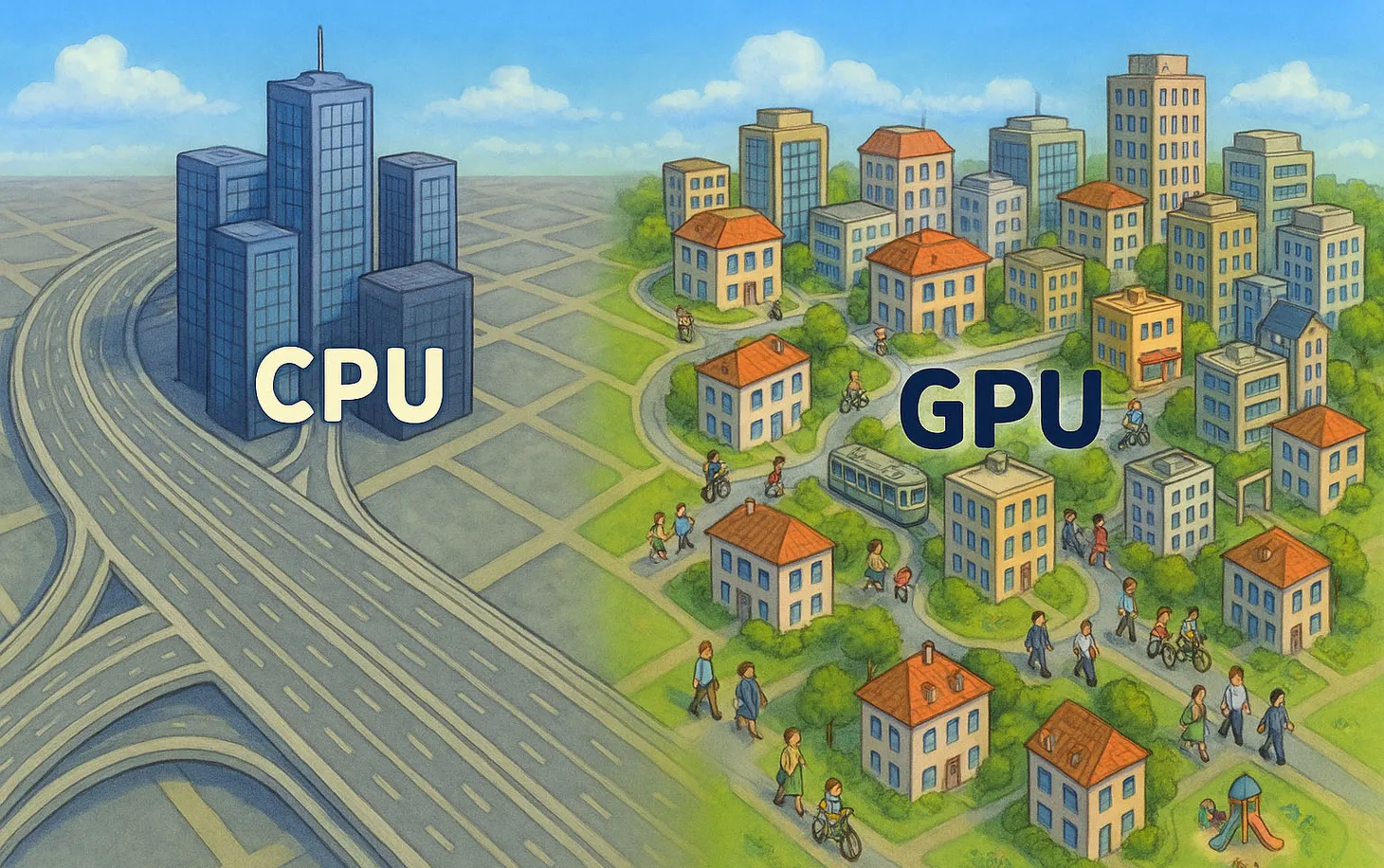

Over the past two decades, online businesses perfected the way in which time spent on site is monetized. Their business models are efficient enough to allow most apps and web sites to provide a variety of services for free. The most common models include:

- Advertising-supported access: Allowing customers to spend as much time as they like in exchange for regular exposure to ads.

- Freemium subscriptions: Providing access to a limited version of the product (or limited access to a full version of the product) while charging for full access.

- Affiliate lead-generation: Providing content or tools that facilitate sales for a third-party which, in turn, pays for any leads it receives.

- Add-on sales: Providing the core product for free but including strong incentives for customers to spend more on additional components such as virtual goods, credits, or special capabilities.

- Asymmetric Pricing: Charging only some customers for access and using them as “bait” in order to attract other paying customers. This model is used, implicitly, by some dating apps. It is also common in the offline world — with nightclubs that provide free entrance to female customers in order to attract male customers who pay a cover charge and (allegedly) spend more on drinks.

In order to employ these business models successfully, online companies rely on a deep understanding of their customers: they collect and analyze piles of data and are able to predict the lifetime value — and the cost of acquiring —each type of new customer. They also understand what triggers different behaviors and which elements of the customer journey trigger people to leave, engage, or make a buying decision.

The wealth of customer data and the deep integration of (online) space, content, and commerce makes it possible to assign a specific dollar value to each individual “visitor”. Google and Facebook have made billions from enabling advertisers to bid for each glance, visit, or click.

Space is Time

Real estate sites are not internet sites. Online, every visit is logged, cookies allow operators to follow their customers around, and all data is digital and structured in a way that makes it easy to analyze.

Soon, real estate operators could access data that is just as detailed. As we pointed out in an earlier article about Artificial Intelligence, new tools can scan building security cameras to figure out what visitors bring into into the building, who they’re talking to, what they are talking about, and what makes them happy or sad.

Some tools can even infer your visitors’ IQ and political opinions, and the cost of their clothes. And just as with online methods, a lot can be gleaned without requiring customers to provide self-identifying data. Artificial intelligence can estimate visitor gender, income levels, and spending habits by analyzing photos of your visitors’ feet as they walk into your space— without having to scan anyone’s face or ID.

Such deep analytics are already common in the offline retail world — where traffic can be easily tied to specific transactions— and are making their way into the office and residential world.

WeWork… again

WeWork, for example, derives significant income from advertisers who conduct product activations inside coworking spaces. Such advertisers can receive detailed information on who walked into the space, at what time, and how long they spent there. In the future, it would be easy to use visual data to analyze each visitor’s response.

WeWork is also leveraging several other online-inspired business models: It derives affiliate income from referring its members to health insurance and office supply companies; it offers cheap membership packages with add-ons for printing, meeting room usage, and additional access; it charges the cool, one-desk workers less (per sqf) in order to make money from large enterprise clients who are attracted by the overall “vibe” and energy; and it uses software to optimize the density and revenue of its physical space.

Perhaps most importantly, WeWork is leveraging Network Effects — the notion that a whole network becomes valuable with the addition of each new component. Every new WeWork member makes the company’s whole offering more attractive since it increases everyone else’s opportunity to interact or find a relevant customer, service provider, or friend. Every new WeWork location makes the company’s whole offering more attractive since it increases the options available to any of the company’s global members.

You’ll excuse me for getting hung up on WeWork. It’s hard not to: As well-known as it is, it is still one of the least understood companies in the industry — and one of the few that actually understands where real estate is headed.

Intimate Space

To sum up, real estate is facing a data revolution that will reshape the way space is monetized. Charging straight-up rent will seem old-fashioned compared to all the new ways to squeeze money out of office workers, residents, and shoppers. We’ll explore some of these ways in more detail in the following months.

Meanwhile, recent regulatory changes mean that web users might soon have to pay Internet Service Providers a premium in order to protect their privacy. This might one day be a relevant business model for physical space as well: Pay us rent, and we promise we‘ll give you only space — no tracking, no ads, and no surprises.

Dror Poleg Newsletter

Join the newsletter to receive the latest updates in your inbox.