Inequality and Abundance

We cannot eliminate inequality, but we can make it irrelevant.

Morrissey once wrote that money changes everything. But economists and psychologists disagree. In many cases, giving people more money does not make them happier and does not make them spend more. People don't think about their income in isolation; they think about it in relative terms, and their feelings and behavior change in relation to whether or not other people around make more (or less) as well.

This topic came up in my conversation with Jim O'Shaughnessy a few weeks ago. I mentioned we're headed for a world with unprecedented inequality. Jim proceeded to ask me whether humans can handle a concurrent increase in quality of life and inequality.

Jim: My concern is we're going up against our base programming, our base human OS, where humans are essentially mimetic creatures. And we tend to compare ourselves. In the old days, we compared ourselves to those around us. We had a limited group of people, a limited group of friends or family, et cetera. And the comparisons were probably closer to us... But now, we're comparing ourselves, as you put it, with superstars. Are we battling our base code here where prestige comparison... You'll endlessly see people say, which choice are you going to make? You have a job, you can double your compensation from a $100,000 to $200,000, but all of your colleagues are going to go from a $100,00 to... [a lot more]. What do you think some of the solutions for that, given the technology platforms, given the leverage they give us, how are we going to solve that?

Jim echoed research by Daniel Kahneman and others about income, feelings, and behavior. Let's survey a few of these before we return to Jim's question and the main topic of this article.

Money and happiness

In the 1940s, economist James Duesenberry developed the "Relative Income Hypothesis." Dusenberry argued that people care more about how their income compares to others than how much money they have. If your neighbors get richer, you might spend more to keep up, even if your own income hasn't changed. This also means that people with lower incomes spend a higher share of their income even if they don't have to. They see more people in higher income brackets and feel compelled to catch up. Meanwhile, those at a higher percentile in income ranking might save more.

The relative income hypothesis contrasts with older theories that focused only on absolute income and assumed individual spending increased together with income. Dusenberry pointed out that social context matters, and comparisons to others impact people's financial behavior.

In the 1970s, economist Richard Easterlin studied the relationship between income and happiness in different societies. He noticed what is now called the Easterlin Paradox: More money makes people happy, but only up to a point. Beyond a certain level of income, money doesn't make you much happier. So, in a rich country, people aren't necessarily happier than those in a poorer country as long as basic needs are covered. Easterlin also noticed that the impact of higher income on happiness diminishes over time — meaning people might get an initial "high" from additional income but then revert back to their previous level of happiness.

Easterlin and others offered several explanations for the apparent paradox. One is that people notice their own lives first, and thus get excited when their income rises, but once they realize that other people have also become wealthier at the same time, the effect diminishes. They also pointed out the social comparison in Duesenberry's relative income hypothesis, arguing that once people's basic needs are met, the stress from keeping up with the gains of those around you offsets any absolute increase in well-being.

Finally, psychologists pointed out that the paradox (more income = stable happiness) could be explained by "hedonic adaptation." Brickman and Campbel theorized that humans have a natural tendency to take things for granted once they get used to them — and to strive for more even once their goals have been met. This adaptation "condemns men to live on a hedonic treadmill, to seek new levels of stimulation merely to maintain old levels of subjective pleasure, to never achieve any kind of happiness or satisfaction."

More recently, the work of Daniel Kahneman, author of the bestselling Thinking, Fast and Slow, reinvigorated the debate about income and well-being.

Irrational and unhappy

Kahneman (and Deaton) added more nuance to the debate, distinguishing between quality of life and people's perception or evaluation of their own lives. Surveying new data, they concluded that well-being doesn't improve meaningfully above a certain level of income, but people do think more positively about their lives. In other words, higher income doesn't make your daily life happier, but if you stop to think about it, it does make you think more positively about your life.

As a result of Kahneman's popularity, the complex relationship between income and happiness is often bundled with his broader focus on human biases and flawed decision-making. At a glance, people's tendency to care about relative rather than absolute income does seem irrational — if you're making more money, why should you care whether someone else made even more? Why should your happiness with your own increased wealth diminish due to other people's success?

This is the "base programming" Jim was referring to in our conversation: the apparent human tendency to compare and never have enough. And when inequality increases and people are constantly exposed to the antics of the world's rich and famous, this programming can make most people terribly unhappy. They are so unhappy that even if their own lives constantly get better, they might still choose violence or give up on the whole game.

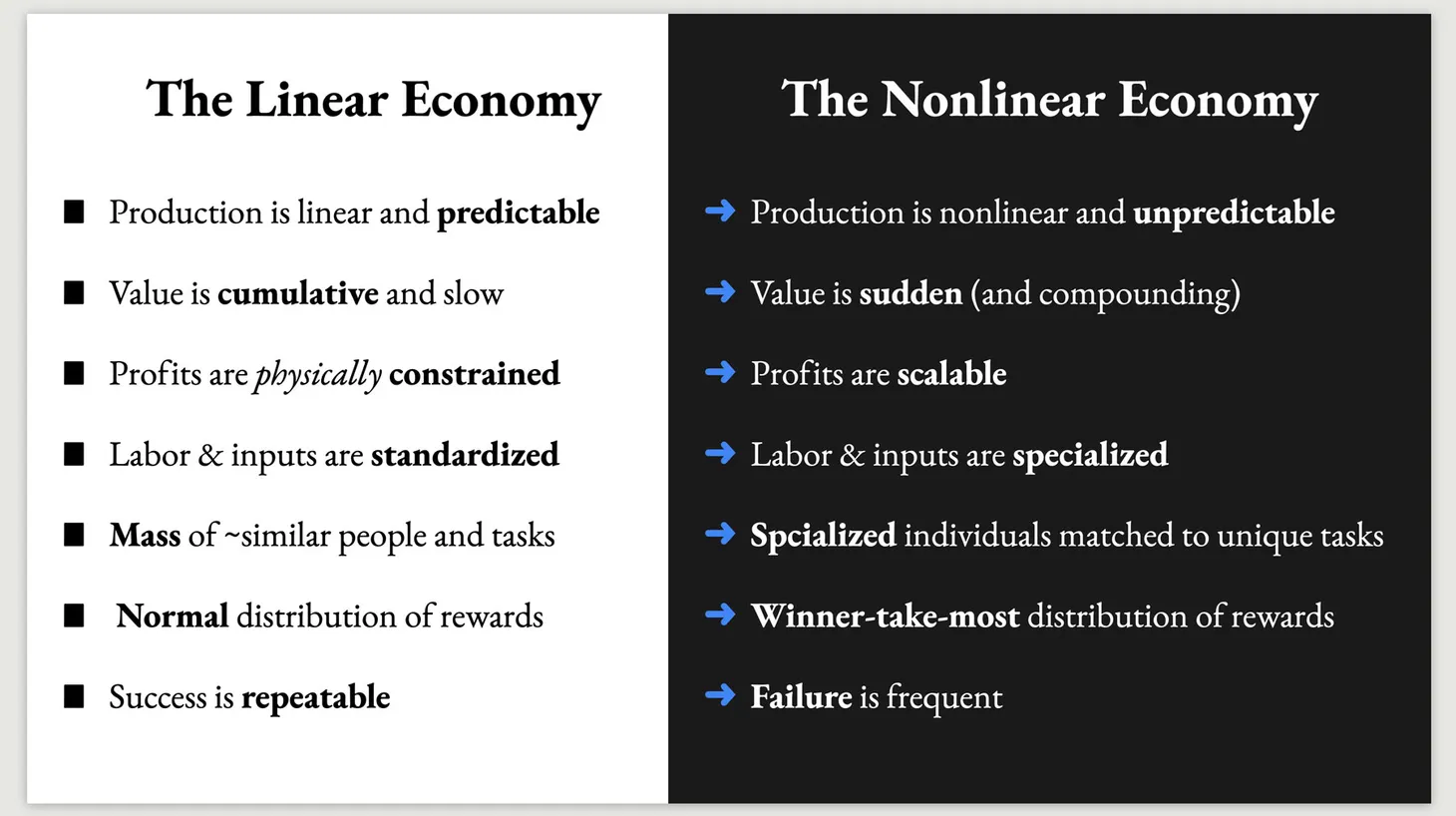

I believe that further technological progress and economic growth will lead to higher inequality. Further, it seems like inequality is a byproduct of increased efficiency. The industrial economy of the 20th Century produced less inequality because was more constrained and less efficient. Things changed more slowly, markets were smaller and less globalized, and the most popular products had high marginal costs that prevented exponential profits.

Based on the above, this leads to a pessimistic prognosis. It implies we're facing a trade-off between efficiency and happiness, between technological progress and social stability. Put differently, it means that humanity is better off staying poorer in absolute terms rather than richer in absolute terms (but with most people becoming relatively poorer than the very rich).

But is that really the case? Are we really that irrational?

I think not.

Rational panic

Daniel Kahneman is most famous for Prospect Theory, the idea is that people tend to make choices based on how they think they'll feel about the potential gains and losses rather than on the actual probabilities of those outcomes.

As I previously summarized, a core tenet of prospect theory is the notion that people tend to overestimate low-probability events. For example, the theory suggests that spending on insurance is influenced by loss aversion and the overestimation of low-probability events, leading people to seek protection against potential losses and rare events, even at a higher cost.

By "loss aversion," Kahneman refers to his theory on how people decide when to gamble and when to stick to a guaranteed outcome. He points out that humans tend to be more cautious when they stand to gain something and more willing to take risks when trying to avoid or minimize losses.

Kahneman sees this asymmetry as a bias driven by emotions rather than a cold calculation. Or, as he would put it, driven by fast, intuitive-emotional thinking (System 1) rather than slow, systematic-rational thinking (System 2). Kahneman argues that humans tend to experience the pain of losses more intensely than the pleasure of equivalent gains, making them more risk-averse in the domain of gains and risk-seeking in the domain of losses.

This is another example how, on paper, many human behaviors are clearly irrational and inconsistent. But things get more complicated when you apply the theory to real-life situations. If you take a risk and die, you can't take any more risks, and the game is over. If you avoid risk and survive, you can always gain something else tomorrow. Likewise, if your capital is finite and you lose all of it on one bet, you're out of the game. But if you only bet some of it and gained less than you could have, you can always make another bet tomorrow.

And in many situations, we have limited information on the costs and consequences of our actions. We're not dealing with the choice between a "sure thing" and a "gamble"; we're dealing with two different gambles with unknown consequences. Hence, we are forced to gamble whether we like it or not, so it makes more sense to make bets that have a higher potential upside — within reason.

The point is that in many real situations, it is actually rational to "overstimate" low-probability events. In a recent podcast, Nassim Nicholas Taleb discussed the bungled govermnet reponse ot Covid-19. He said the core of the error was not the lack of response, but the fact that the response was proportional to the probability of a massive disaster. Instead of responding deciseively and with "extreme prejudice", the response acknowledge that something terrible might happen, but since it was not sure it would happen, it only took modest initial steps — it did not shut down all incoming flights or (at least) test and quarantine all incoming passengers, for example.

The better response would have been to act immediately as if a global pandemic is 100% likely. This doesn't mean we should always lock down the borders, but that if there's enough reason to do anything at all, the response should go all in. As Taleb puts it: "If you have to panic, panic now."

This idea is easier to grasp with physical threats: If you wake up and smell smoke, you don't put a bucket with water next to your bed "just in case" and go back to sleep; you secure the whole house and alert the fire department. It is harder to grasp with abstract threats like financial crises and pandemics; it seems rational to "not panic" and only test people who arrive to the hospital rather than check everyone at the border.

You get the idea. Whether a behavior is rational or not depends on context. And things that seem irrational in theory are often rational in practice. Further, behavioral that are irrational in one era might be rational in another.

Jumping out of bed

Reviewing Kahneman's work, I noticed that its value seemed declines over time — farther we move from the old industrial world, the less it had any practical use. This happens because the world is becoming increasingly complex and unpredictable, and outcomes are increasingly "outsized"; winners are bigger than ever and crises — whether pandemics or financial crises — spread faster and affect more people.

In the 1950s or even the 1990s, the world was more constrained and activities more siloed, and it was indeed irrational to overestimate low-probability events. But in 2020, it is rational to overestimate them. More preceisely, it is rational to overreact to the potential onsent of such events, because even though their probability is low, their effects are swift and devastating. In an interconnected world, if you smell smoke in China (or in Lehman Brother's HQ), you must jump out of your bed in America (or in Iceland).

Which brings us back to the question of income and happiness, and to whether humanity's irattional response to inequality presents a lose-lose choice between slower growth or social unrest. We took a long but hopefully interesting detour to show that what seems irrational in one economic environment (1950s) can be rational in another (2020s). The same insight applies to our approach to inequality.

Playing different games

I remind you where this article began. Jim O'Shaughnessy asked me whether people revolt against rising inequality even if their own income inceased (but to a lesser extent than some of their peers).

I gave an elaborate response, but here's the gist of it: It is rational for people to worry about inequality because we are living in a zero-sum game. The way to eliminate concerns about inequality is to move into a non-zero or positive-sum game.

What does this mean? Why are we in a zero-sum game?

For one, while many people are are getting richer, the overall quality of services we receive (in America) seems to diminish: the roads are full of holws; healthcare is more expensive and health outcomes are worse; housing is increasingly unaffordable; public education quality is deteriorating; private education is increaisngly expensive. We can argue about the causes for these trends, but their effect is a feeling that if you're not moving upwards — quickly — you're falling behind.

And because of the increasingly unequal distribution of income, this feeling is prevalent even those in upper-middle class or even in the 99th income percentile. As I told Jim:

In New York, you can make $500,000 a year, but there'll be hundreds of thousands of people who earn as much, and there's be thousands of people that make $50 million a year. That's going to be a real problem for you.

I just read that last year in America, 13,000 weddings cost more than a million dollars. So, that's $13 billion spent on weddings. It may sounds like a lot, but when you look at it statistically, there are about 2 million weddings in America every year, so 13,000 is really 0.06% or so. It makes sense statistically. But when you translate it to the real world, you're like, wow, 13,000 weddings! Probably a third of these are in New York. So, every week in New York, there's a few dozen weddings nearby cost a million dollars. And whoever else wants to get married has to compete against of them pulling all the resources away.

Weddings are just an illustration, but the same dynamic affects more basic needs.

Living in New York metropolitan area, you feel like you can make half a million dollars a year and still feel poor, or at least financially insecure. People who don't live here may think this is a diconnected think to say. But it's true. We're on a power-law slope, so even if you're in the 99th percentile or the 99.3th percentile, there are still tens of thousands of people that are ahead of you — and sometimes far ahead of you — and they are competing for the same resources, the same doctor, the same school, the same parking lot, the same everything.

This type of competition for limited resources makes it rational even for very high earners to worry about inequality. If I make $500,000 a year, I still suffer from the fact that thousands of people around me make 100 times more. It's a zero-sum game, in which some people's gains crown out other people's benefits.

How do we change the game?

Embracing Abundance

We cannot change human nature. And we don't have to. And, assuming we continue to innovate and grow, we probably won't get rid of inequality. But we can make inequality less costly; we can turn the economy into a positive-sum game. How do we do that? With technology!

Imagine a world with clean and abundant energy, universal and incredible healthcare, and free and personalized education. And lower energy plus remote presence also unlocks many more places to live and drives down the cost of housing. All of these are now within reach. We already have nuclear power, and other forms of renewable energy are becoming cheaper and more reliable. We already have incredible software and hardware that is nothing short of miracolous and can be put to much better use in education and healthcare. We already have the ability to make much better use of the built world to enable more people to access opportunities and reduce the impact on the environment.

Our institutions have to adapt and embrace the possibilities and help usher in a positive-sum world. In such a world — or, at least, such a country — no one will have to be anxious about their basic needs or feel threatened by the higher income of some of their peers. This is not a utopia or a dream. People will still have enough to worry about, but there will be a pretty high baseline for everyone. On average, such a baseline already exists — we are much richer than we were 50 or 100 years ago. But in practice, we have tens of millions of people suffering from disease, homelesses, or just plain old harship to get by. This type of zero-sum world is a choice. We can choose differently.

There's more to say, but the point is that we can have growth and innovation and happy people, even if inequality would increase. The way to achieve this is not by eliminating inequality (and growth) but by making inequality costless — by ensuring that some people's spectacular success does not hurt other people. I suspect this argument would trigger people from both sides of the aisle, and it needs to be refined and fleshed out. But this is the way forward: Not anti growth or anti tech, and not careless or cavalier about the implications. We are facing some real dilammas. The bad news is we'll need a few miracles to forge a sustainable path forward. The good news is we now have the power to make miracles.

To be continued.

Best,

Elsewhere on the internet

- I spoke to The New York Times' Jane Margolies about how universities are capitalizing on the office crisis.

- Nassim Nicholas Taleb and WSJ's Scott Patterson chatted with Tim Ferris about risk, independence, and skepticism.

- A machine vision startup bought one of the world's largest parking operators, in an epic example of how software is eating the world.

- The Financial Times has a great visual explainer on how generative AI works.

- Francois Chollet, one of the leading AI researchers at Google, published a presentation about what AI still can't do well. He also quoted me which is kinda cool. The second half is quite technical, but his overview of the challenges is accessible and worthwhile.

- A new study finds that good looking investment managers tend to underperform their uglier peers. One more reason to avoid in-person meetings.

- Japanese firms are (still) leaving Tokyo, thanks to remote work and unreasonable cost of maintaining expensive and mostly-empty offices.

- Working from home can cut your carbon footprint in half, according to data published in the Proceedings of the National Academy of Sciences.

- Remember the headlines about Zoom calling people back to the office — and my rebuttal of these headlines? New data from the Washington Post shows that 65% of Zoomers are still remote because they don't live near an office; and those who do only have to come in for two days a week. This pencils to about 14% office utilization. Not much of a comeback after all!

I research technology's impact on how humans live, work, and invest.

💡Book a keynote presentation for your next offsite, event, or board meeting.

🔑 Become a Premium Subscriber to support independent research and unlock subscriber-only content, online meetups, and more.

❤️ Share this email with a friend or colleague

Dror Poleg Newsletter

Join the newsletter to receive the latest updates in your inbox.