It’s Time for a National Success Fund

There’s a better way to spread the fruits of innovation.

In our current economic system, the more successful some people become, the harder it is for everyone else to become successful, and the less likely it is for society to continue to flourish.

This is not a matter of Left vs. Right; it's just how things are. This happens for three main reasons. We'll explore these in a moment. But first, let me propose a solution: America should treat innovation the way Norway treats oil.

- We need to incentivize exploration;

- We need to applaud success; and

- We need to rely on an independent fund to invest the profits for society's long-term benefit — and to ensure sustainable production.

What's wrong with the way things are? And how can a National Success Fund help?

Let's dive in.

Drowning in Gas

When society hits the jackpot, things become dangerous. In 1995, a study by economists Jeffrey Sachs and Andrew Warner showed that countries with "abundant natural resources" tend to have slower economic growth.

This phenomenon is known as the Resource Curse. In addition to slower economic growth, countries with abundant natural resources tend to have "less democracy, or worse development outcomes than countries with fewer natural resources."

The challenge of absorbing a windfall of natural resources is not restricted to poor and developing nations. In the 1960s, the Netherlands started producing and exporting natural gas from a massive, recently discovered field in the country's northeast. International demand for Dutch gas drove up the value of the local currency.

A stronger currency made the Netherlands wealthier, but it also made it difficult for the country to export anything other than gas. Priced in the local currency, Dutch-made goods became too expensive compared to goods made by competing countries. While gas exports grew, other sectors of the economy started shrinking, ultimately leading to a recession.

Following the Dutch experience, economists use the term "Dutch Disease" to describe situations in which massive success in one sector undermines the economy's long-term prospects as a whole.

In 2022, the world's most successful economies are plagued by a similar "curse" or "disease." But before we get to that, let's explore two other theories of unbalanced growth.

Expensive Inefficiency

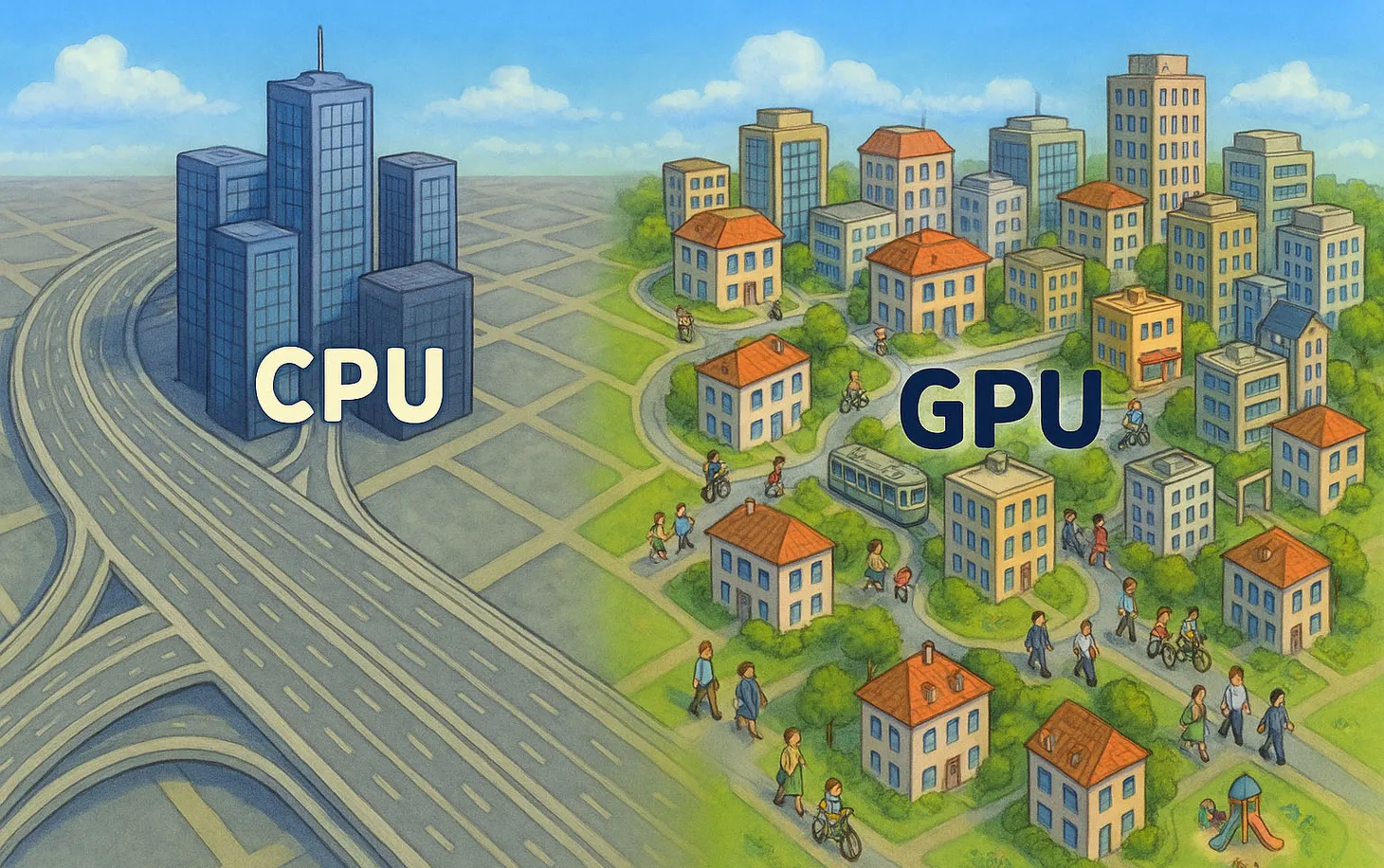

In 1968, economists William Baumol and William G. Bowen tried to figure out why the performance arts industry was in constant financial trouble. They ended up identifying a dynamic that affects the overall economy: When some industries become more productive, other industries necessarily become more expensive.

Standard economic theory predicts that higher productivity leads to higher wages— when people produce more output in the same amount of time, they earn more. Productivity increases due to adopting new methods, acquiring new skills, and introducing new tools and technologies.

Baumol and Bowen noticed something unusual. In the performing arts sector, salaries continued to rise even though the industry as a whole did not become more productive. The number of people and person-hours required to produce a show remained the same, but costs kept increasing. As a result, organizations that employed performers were under constant financial duress.

Compare this to the automobile industry. Labor and other costs have gone up there as well. But companies in that sector were constantly becoming more productive, figuring out ways to churn out more widgets for the same number of working hours. The increase in productivity made it possible to absorb higher labor costs. Over time, a car company could grow its output and business while reducing its overall number of employees.

Meanwhile, a string quartet that required four people in 1800 still requires the same number of people in 2022. And so does a doctor's office or an elementary school class. The growth in productivity in the automobile and other non-service sectors did not help make hospitals or schools cheaper. In fact, it made them more expensive.

Baumol and Bower discovered that costs in some labor-intensive sectors are increasing because of productivity improvements in goods-producing sectors. When, say, Toyota figures out how to make more cars with fewer people, it ends up with fewer and more productive employees and vehicles that are priced more competitively. Generally, more productive employees receive higher salaries and spend those salaries on goods such as housing and education.

When a hospital (or orchestra) hires an accountant or administrator, they compete in the same labor market as Toyota. And because Toyota has become more productive (and pays higher wages to fewer people), the hospital is now competing in a labor market where good administrators and accountants expect higher salaries.

Further, living costs increase because of general inflation and the growth in housing and education costs (resulting from rising wages in productive industries). And so, while a string quartet still required only four people in 2022, its operating costs are now more than 20 times higher than they were in the 19th Century.

This dynamic — wage growth in industries with low or limited productivity growth — is now called Baumol’s Cost Disease. It has been used to explain the increase in the cost of a variety of in-person services and as an argument for why some services — particularly healthcare, education, and the arts — should be funded by the state and not by for-profit entities.

I write more about this cost disease here. But for our current purposes, it's enough to note that productivity improvements in some industries cause cost increases in industries that aren't improving at a similar rate.

You might already suspect how Baumol's Cost Disease affects income inequality. But before we tie it all together, let us briefly explore one final theory.

Too Much of a Good Thing

Left to their own devices, people often fail to preserve valuable resources. Individually, they do not mean to do harm. But collectively, human action often destroys shared resources or reduces their value to everyone involved.

Examples of this are everywhere. When too many people fish in a lake, the animal population cannot replenish itself and dies out completely. When too many people drive on a highway, traffic draws to a standstill, making it impossible for anyone to reach their destination. When too many people spend too much time at a public park, the grass dies out and has no opportunity to recover.

The American ecologist Garrett Hardin calls this dynamic the "tragedy of the commons." Harvard Business School provides a succinct definition:

"The tragedy of the commons refers to a situation in which individuals with access to a public resource (also called a common) act in their own interest and, in doing so, ultimately deplete the resource."

The tragedy of the commons is a coordination problem. The uncoordinated use of a valuable resource leads to its depletion and makes society poorer.

What does all this have to do with our current predicament? Let's see.

The Scalable Individual

Oil is less important than it once was. The most valuable resource of the post-industrial world is humanity itself. Our period is unique in the scope and speed at which a single human being, or a small group of people, can impact the well-being and behavior of billions of people.

We live in an era when one man's company can launch more satellites into space than Russia and China combined, when a college student can launch a social network that captures the attention of 3 billion people. When female scientists can pioneer a method to edit our actual genes. When a 10-year-old girl's rendition of an old campfire song can accumulate 11 billion views.

The same dynamic also plays out at a smaller scale in a variety of other fields. From fitness instructors and doctors to university professors and even strippers, a smaller number of people can now serve a larger number of customers. Even within companies, individuals can generate more economic value than ever. For example, each of the 164,000 employees at Apple generates an average of $12 million in market capitalization and about $2.5 million in annual revenue.

Never in history was it possible for so few individuals to become so successful so quickly and have such a profound impact on how everyone else on the planet lives and behaves.

"Succesful" is probably not the right word. I am still looking for a better definition. But my general point is that a small group of people can now be as impactful as a new oil field, plague, or empire. For worse, but especially for good. It means we need far fewer people to generate the wealth required to provide everyone with a decent lifestyle. The continuing evolution of AI, mixed reality, and the internet will intensify these trends.

But there are a few obstacles in our way. Economic success can increase inequality, undermine the quality of life for the majority of the population, and diminish the odds of future success. This happens through three different mechanisms.

The Silicone Valley Syndrome

In 2019, two Yale Ph.D. students set out to explore how the tech boom affected the broader economy in the San Francisco Bay Area. In their paper, Doris Kwon and Olav Sorenson describe how an influx in venture capital investment can result in a type of regional Dutch Disease:

- The booming tech sector sucks talent away from other sectors, drives up the cost of doing business, and makes it difficult for exporters of services and non-tech goods to compete with peers in other regions.

- As a result, other white-collar employers get crowded out of the region and shrink their footprint, eliminating middle-class jobs.

- Meanwhile, rising salaries in the booming tech sector lead to higher spending by some people, increasing demand for local services (fancy restaurants, personal trainers, sporting events, shrinks, orchestras), resulting in more working-class jobs.

- In addition, venture capital tends to have an uneven effect on salaries. VC-backed companies tend to pay more than non-VC-backed firms for high-skilled employees. At the same time, VC-backed firms tend to pay relatively less for less-skilled employees. (For example, a VC-backed unicorn might overpay in-demand engineers, but it would also underpay its cleaning staff or delivery people).

Kwon and Sorensen called this phenomenon The Silicone Valley Syndrome: An expansion in the number of highest and lowest-paying jobs. Resulting in a hollowing out of the middle and an overall increase in inequality. The middle class disappears while "the poor do no better" and "the rich get richer."

But it doesn't end there.

Running to Stay Put

There's another way in which a boom in some sectors contributes to inequality. As we've seen in our discussion of Baumol's Cost Disease above, a productivity increase in one industry can drive a cost increase in other sectors. This means that when some people earn much more, everyone else needs to spend more to maintain their current lifestyle.

As a New Yorker, I know this dynamic first-hand. Productivity growth in the local financial and tech sectors helped drive up the cost of healthcare, childcare, and education (sectors that did not enjoy similar productivity gains). Even though I don't work for Google or Goldman Sachs, my lifestyle has become much more expensive. And by "lifestyle," I am talking about access to basic medical care and providing my children with a decent education.

(As a side note: This dynamic applies even without real productivity growth. As long as investors pour more money into tech and finance and drive up salaries in these sectors, costs in other sectors will go up. Ten years later, if and when investors realized all those tech companies were not worth it, no one will refund me for the overpriced healthcare and education that I consume — but the price of my home might crash. But that's a different story.)

The critical thing to note is that the success of some makes basic services more expensive for all. The counter-argument is that healthcare and education should embrace innovation and become more productive to keep costs down. I agree. But for now, they haven't done so at a comparable rate to other sectors. And in any case, productivity gains in some industries will always lag behind others.

Baumol's Cost Disease contributes to inequality by making essential services less affordable for most people. The growing cost (or deteriorating quality) of healthcare and education also undermines overall prosperity.

Unsustainable Human Capital

Humans mean well. But our collective actions often lead to bad outcomes for everyone. The ecologist Garrett Hardin called this The Tragedy of the Commons.

When too many people drive on a highway, traffic draws to a standstill, making it impossible for anyone to get anywhere. When cows graze too frequently, the grass dies, and humans get no meat and milk. When we overfish... you get the idea.

Gas and grass are less important than they once were. In 2023, the most valuable resource is humanity itself. The old cliche about people is true: They are our greatest asset. We need to keep them healthy, enable them to experiment, and ensure they make the most of their potential — for everyone's benefit.

Currently, we are "harvesting" brilliant innovations made by wonderful people, but we aren't doing enough to ensure the sustainable "production" of such people. Every person is a lottery ticket who might change the course of humanity. Society needs to produce as many tickets as possible.

How to "produce" more people who can change the world?

1. We keep everyone healthy;

2. We teach everyone the latest skills;

3. We ensure everyone has access to opportunity — online, but also offline: we make sure there's enough housing where people want to live, we make sure there's good infrastructure to enable people to move around, etc.; and

4. We provide people with a basic level of services regardless of their income, so they feel comfortable taking risks and trying new things.

Why is that so hard?

In one word: Politics.

The Norwegian Alternative

Our leaders are generally focused on short-term priorities, beholden to existing economic interests, and bogged down in their fights with each other.

This is true for both Left & Right. And "Success" only makes it worse. A booming tax base can cause the government to become less efficient, more complacent, and more detached from reality (California is a case in point).

More broadly, tech-powered success can increase inequality, undermine the quality of life for the majority of the population, and diminish the odds of future success.

This happens through three (or more) mechanisms:

- The Dutch Disease: When one industry is booming, it reshapes the economy and makes it harder for other industries to remain competitive. This is true for tech as it is true for gas.

- Baumol's Cost Disease: When some people start to earn much more, everyone else needs to spend more in order to maintain their current lifestyle. And the biggest impact is on crucial things like education, healthcare, and essential services.

- The Tragedy of the Commons: We are "harvesting" brilliant innovations made by wonderful people in a way that diminishes the production of healthy educated people who are willing to take risks.

How do we sidestep this mess?

We follow Norway's example. In its own words:

In 1969, one of the world’s largest offshore oilfields was discovered off Norway. Suddenly we had a lot of oil to sell, and the country’s economy grew dramatically. It was decided early on that revenue from oil and gas should be used cautiously in order to avoid imbalances in the economy.

Norway set up an oil fund designed to avoid the diseases and tragedies listed above. Specifically, the fund:

1. Prevents government from using more than 20% of oil revenues;

2. Reinvests with a long-term view — both socially and financially to ensure the maintenance and growth of the country's financial "treasure" and continuing investment in human capital and in further exploration; and

3. "Absorbs" gov't budget surpluses, so the government is incentivized to save money during good years instead of spending it immediately.

The Norwegian fund is not 100% independent of government, but there are laws and norms that separate it from day-to-day politics and short-term considerations.

A similar arrangement is needed in countries and states that rely on innovation, particularly the United States. It will help allocate the fruits of success for the benefit of society at large, sustain and increase innovation and entrepreneurship, and force more discipline and responsibility on politicians from both sides of the aisle.

Epilogue

There is an ancient moral argument for why all people should have access to quality education and healthcare: All men and women were created in God's image and deserve to live in dignity. There is also an old economic argument: The economy needs a mass of well-educated and healthy people in order to ensure economic growth and prosperity.

That economic argument is no longer true. In the 20th Century, investors and entrepreneurs needed armies of well-educated employees in order to make money. The education system was designed to serve this need and "produce" people with standardized education that are ready for relatively structured industrial and office work.

However, in the 21st century, it is possible for investors and entrepreneurs to make money with far fewer employees. As discussed, one great idea can be brought to market by a relatively small team and entertain or feed or heal billions of people.

It's easy to conclude that we no longer need to educate so many people and spend so much on their health and well-being. Implicitly, this seems to be America's operating assumption: Let the winners win, and let everyone else struggle to access basic services.

But even from a purely economic perspective, this is the wrong conclusion. Yes, the economy can rely on fewer people to produce what it needs. But it's impossible to know in advance who these people are. As work becomes more creative and less linear, the only way to come up with world-changing inventions is to constantly try new things, in new ways. The best way to do that is to ensure that as many people as possible can participate in the game.

The economy is becoming a lottery. To ensure the game can continue, we need as many people as possible to participate. And we need to experiment with radically new ways to share the prize. A National Success Fund is an option worth exploring.

Do I have your vote?

This idea needs further development, so your thoughts and suggestions are welcome.

Dror Poleg Newsletter

Join the newsletter to receive the latest updates in your inbox.