Andreessen Pulls a Bezos

Cheap money and power-law profits are killing venture funds and birthing venture firms.

The next cohort of Hype-Free Crypto is accepting enrollments. The previous cohort sold out within a week. Click here for the full schedule and curriculum.

Venture capital investors are big fans of the word "strategy," but they hardly give it much thought in their own business. Historically, venture capital firms competed by outdoing their peers in the same activities; they tried to answer emails faster, be nicer to founders, have a broader network, offer better terms, recruit smarter and better-known partners. Firms differentiated themselves by focusing on different funding stages, sectors, or geographies. But ultimately, their business was quite similar to that of their competitors. Firms that did well had more money to spend on doing the same type of activities even better.

Investors thought they were strategic, but this was only true to a minimal extent. As Michael Porter points out in the book about strategy, acting strategically means "doing different things" rather than "doing the same things better." To understand the difference, compare the competition between Burger King and McDonald's and that between Hilton and Airbnb. The former two companies compete by trying to outdo one another in the same activities (franchising, menu construction, sourcing material, advertising). The latter two companies compete by doing completely different things: Hilton operates whole hotels, trains and employs thousands of service staff, and has strict guidelines on how its rooms are constructed and maintained; Airbnb, on the other hand, operates a website and app and has zero involvement in operating or designing physical assets.

The non-strategic approach worked reasonably well for venture investors until now because they faced limited competition. They did compete with each other, and they sometimes felt the competition was fierce, but they still operated in a world governed by scarcity. There were more risky venture companies looking for money than investors (or dollars) looking for risky ventures.

This world no longer exists. But before we get to that, let's consider an analogy that helps clarify my point about competition.

Real estate investors have competed with each other for centuries. Land is scarce. And yet, owning and operating a good building in a good location required a lot of work, and landlords competed with tenants, employees, and patrons. Competition always felt fierce. But now, when customers can suddenly shop and work from anywhere, competition becomes really fierce. Suddenly, a world of scarcity becomes a world of abundance. But most landlords don't notice and continue to do the same old things, hoping they can win by simply doing them better — just like in the good old days.

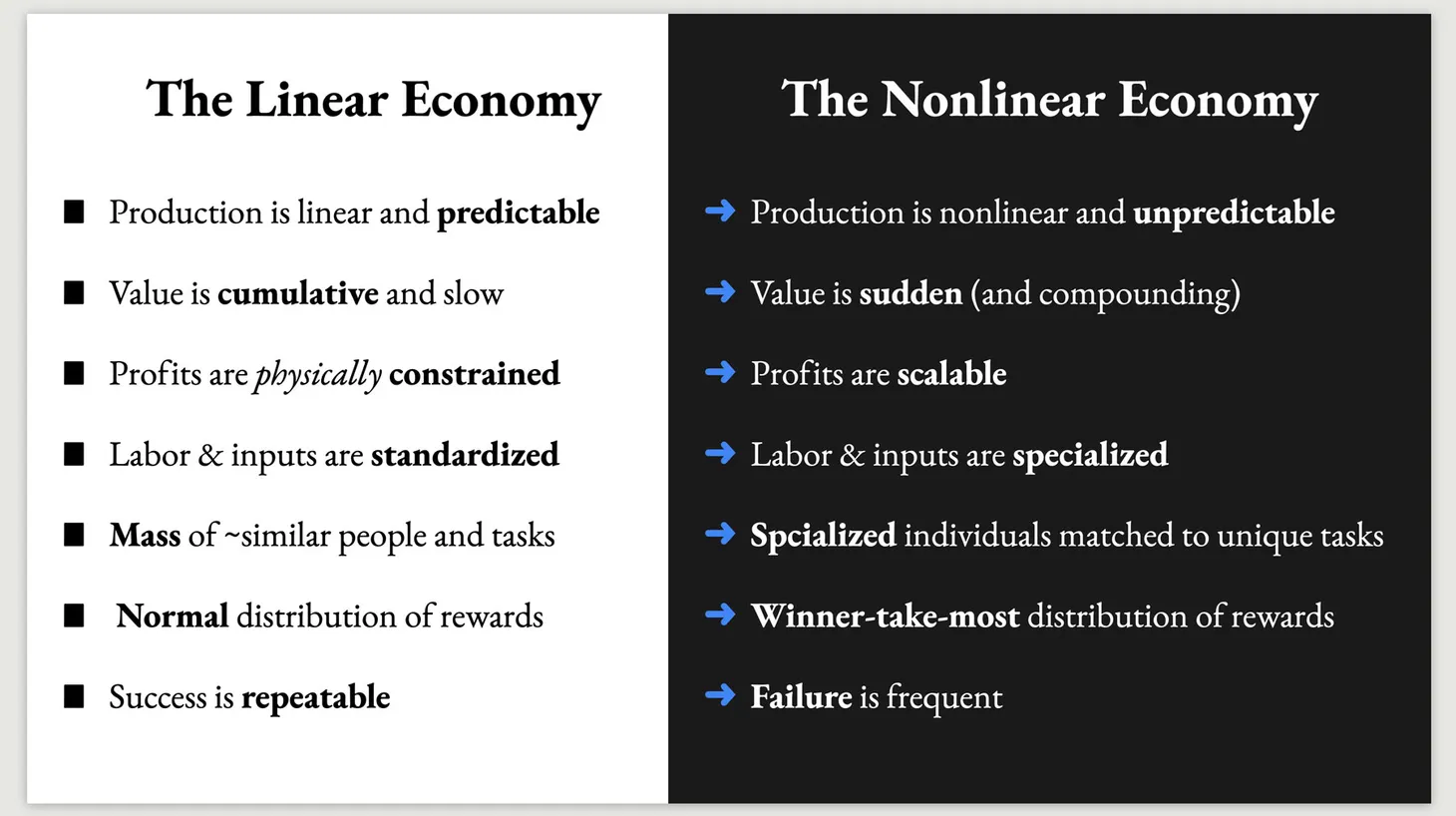

The same thing is now happening in venture capital, but faster. The world is awash with capital, and even the most conservative institutional and retail investors are developing an appetite for riskier bets. This is driven by (1) historically low-interest rates and (2) the winner-take-all nature of many technology-powered businesses. In other words: you are guaranteed to lose purchasing power if you keep your money in so-called safe assets, and a handful of extremely successful investments capture most of the available returns. Investors who try to stay safe or even take risks but miss out on the biggest winners end up far behind.

How do you compete in such a world? You think strategically. In the case of venture capital, that means doing things your competitors aren't doing. And that's exactly what Andreessen Horowitz (A16Z) is doing. The firm is on a hiring spree, recruiting new partners and former government officials, writers, editors, and more. A16Z is no longer building a venture capital firm; it is building a new type of company with a thick management layer that helps support its multiple portfolio companies with marketing, legal, lobbying, and technical resources. It's no longer venture capital; it's a venture corporation.

By doing more things, A16Z becomes dramatically more attractive and valuable to entrepreneurs, increasing the likelihood it won't miss out on the biggest winners.

The only problem is it costs a lot of money. Doing all these new things and staffing all these new departments is expensive. Does this mean A16Z will soon go bust?

Not at all. Andreessen is taking a page out of Amazon's book. Jeff Bezos famously said, "Your margin is my opportunity," highlighting his willingness to minimize his short- and medium-term profits for the sake of massive long-term ones. For years, Amazon operated at a loss or near-loss, investing its free cash into infrastructure, new business lines, and various other things that looked like a distraction for a "website that sells stuff." Over the long term, these investments did not just enable Amazon to ultimately become profitable; they enabled Amazon to become the biggest winner in several giant markets with strong winner-take-all dynamics (online commerce, cloud computing, and, soon, 3rd party logistics).

More importantly, Amazon did not just win. It completely changed the economics of online commerce and forced its competitors to take on new costs and new activities in order to remain relevant. Other retailers are now forced to catch up with Amazon's various activities or become dependent on partnerships with companies such as Shopify, Facebook, Stripe, etc.

A16Z is doing the same thing to the venture capital industry. It is not just acting strategically in order to gain an advantage. It is imposing a whole new cost structure on its competitors. As a result, a handful of other firms will try to catch up and become equally giant; a variety of "boutique" angel investors and syndicates will live off relatively small (and absolutely large) crumbs, and many of the big-but-not-big-enough funds that currently exist will disappear or gradually become irrelevant.

Have a great weekend and a happy new year!

👋 If you enjoyed this piece, subscribe to my newsletter for a weekly analysis on the history & future of finance, work, and cities.

One more thing

I'm excited to share with you a super early look at something I'm building.

I'm designing a new course about cryptocurrencies, NFTs, and Decentralized Finance — for grown-ups. By grown-ups, I mean people with significant experience in other industries who wish to get a solid and impartial understanding of an exciting new world.

I strongly believe that those who understand and harness the potential of these new technologies and tools will have a significant leg up within their own industries. I'm excited to filter through the noise and help inform and inspire you to make the most of this opportunity.

I'll be teaching this course live. You'll learn directly from me and a few special guests through several weeks of live video sessions. We'll have community discussions, practical walk-throughs, special guests, and more.

I'll be starting with a small beta group of students so I can perfect the material. That beta program will cost $500 and will be a significant discount over the final price.

Click here if you're interested in joining this small group

There's no payment or commitment yet! This is just letting me know that you're interested in learning more about the course when the time comes. My goal is that by the end of the course, you will:

- Understand how cryptocurrencies and decentralized finance protocols work, their promise, and their limitations;

- Be familiar with the relevant terms, products, and companies in the space;

- Know how to use common tools and products, including crypto exchanges and digital wallets;

- Consider the implications of these tools and technologies for your own industry or business;

- Have a good sense of the broader consequences for society, the economy, and the environment;

- Be able to apply this knowledge in your own personal and professional life; and

- Make a few new friends.

Click here if you're interested in joining this small group.

Best,

Dror

Dror Poleg Newsletter

Join the newsletter to receive the latest updates in your inbox.