Real Estate & AI: Ten Predictions

How will AI affect the value, design, and operation of physical buildings and cities?

🎧 The audio version of this article is available on Spotify, Apple Podcasts, and beyond.

How will AI affect the value, design, and operation of physical buildings and cities? This is the most common question I've been asked at dozens of keynotes I gave this year (book yours here).

The short answer is that nobody knows. We are facing a technological change that is likely comparable to the Industrial Revolution(s). In our connected world, this change will likely propagate faster and won't take decades or centuries to have a meaningful impact on most people, particularly those living in large cities.

Then there's the longer answer. While we do not know what will happen, we can speculate based on historical experience and evaluation of AI's current capabilities and effects. Below are ten predictions, ranging from AI's impact on real estate supply and demand, on real estate as a business and asset class, and on the broader role of places and spaces. The purpose of these predictions is not to tell you what to think but to highlight what you think about.

Let's dive in.

1. AI will make the physical world legible for machines.

In 2017, I wrote about how machine vision will enable operators of physical spaces to know everything about their visitors and customers:

And when it comes to data, real estate is in a position to get it all. Artificial Intelligence can scan security cameras to figure out what users bring into the building, who they’re talking to, what they are talking about, and what makes them happy or sad. It can even infer their IQ and political opinions, and the cost of their clothes.

AI can then use this data to optimize the way office or hospitality space is laid out, and figure out who should sit next to whom. And this is before even looking at data from sensors and IoT devices measuring anything from air quality to toilet paper consumption.

In 5 years, it’s not unlikely that the world’s best real estate operators will know more about their “users” than any web site ever did.

It took six years, and these capabilities are now available off-the-shelf. You can upload an image or screenshot to ChatGPT, and it can tell you precisely what's going on within it — how many people, what they are wearing, their mood, their likely relationship and socio-economic status, and more. It can even guide you on how to fix different things.

Google, meanwhile, just exposed its own "multi-modal" AI capabilities — referring to the software's ability to understand different modes of interaction: text, images, and voice.

The following demo video is edited for brevity, and some of the interactions were in text rather than voice, but it still gives you a sense of where we are and where we're headed.

2. AI will make the physical world navigable for machines.

AI's ability to see, speak, and understand the world helps bridge the gap between the digital and physical realms. It also makes it possible for AI to take on more physical tasks.

Self-driving cars are getting closer. Waymo, Google's self-driving venture, now operates a limited taxi service in San Francisco. According to some researchers, they're already safer than human-driven cars. A joint study by Waymo and insurance giant Swiss Re compared insurance claims resulting from human vs. autonomous drivers in comparable situations. The results were impressive:

in over 3.8 million miles driven without a human being behind the steering wheel in rider-only mode, the Waymo Driver (Waymo’s fully autonomous driving technology) incurred zero bodily injury claims in comparison with the human driver baseline of 1.11 claims per million miles. The Waymo Driver also significantly reduced property damage claims to 0.78 claims per million miles in comparison with the human driver baseline of 3.26 claims per million miles.

Autonomous machines will not be restricted to the streets. Indoor robots of various kinds are improving quickly. Tesla recently announced the latest iteration of its service robot, Optimus. As you can see in the video below, it can walk around and manipulate delicate objects. It can't make an amazing omelet yet, but it can pick up and move around eggs.

There’s a new bot in town 🤖

— Tesla Optimus (@Tesla_Optimus) December 13, 2023

Check this out (until the very end)!https://t.co/duFdhwNe3K pic.twitter.com/8pbhwW0WNc

3. AI will make remote interactions richer and more compelling.

In May 2021, during the Covid lockdowns, Google announced a new technological solution for virtual meetings. Project Starline enabled people to have holographic meetings that felt incredibly real.

The catch? These meetings required one to sit in a very expensive booth decked with special sensors, lighting, and cameras.

Less than two years later, generative AI enables Google to provide a comparable solution with much cheaper hardware and smaller cameras that can fit into every office or home.

How does it do it? Instead of scanning every bit of your body from every angle, the AI generates aspects of the image and video that seem real based on the limited information it takes through the cameras.

Meta has also made incredible progress in making virtual communication feel more real, as exemplified in this virtual conversation between Lex Friedman and Mark Zuckerberg.

Here's my conversation with Mark Zuckerberg, his 3rd time on the podcast, but this time we talked in the Metaverse as photorealistic avatars. This was one of the most incredible experiences of my life. It really felt like we were talking in-person, but we were miles apart 🤯 It's… pic.twitter.com/Nu8a3iYWm0

— Lex Fridman (@lexfridman) September 28, 2023

Other advances in machine learning make it easier to scan physical environments and create vivid virtual copies that users can walk through. Virtual copies of physical environments that used to require expensive sensors and months of work can now be generated within minutes or hours with relatively cheap hardware. Check out the explainer on Gaussian Splatting in the video below for one exciting example.

4. AI will make digital collaboration unavoidable.

Beyond the physical world, AI enhances popular digital tools such as word processors, spreadsheets, and other apps that workers use every day. These product pages from Microsoft and Google provide an overview of the latest features.

As a result, more and more work tasks are moving into the digital realm. Even people sitting next to each other at the office collaborate virtually through digital tools. This contributes to a flywheel that expedites the adoption of AI and distributed work.

5. AI and remote work reinforce each other's adoption.

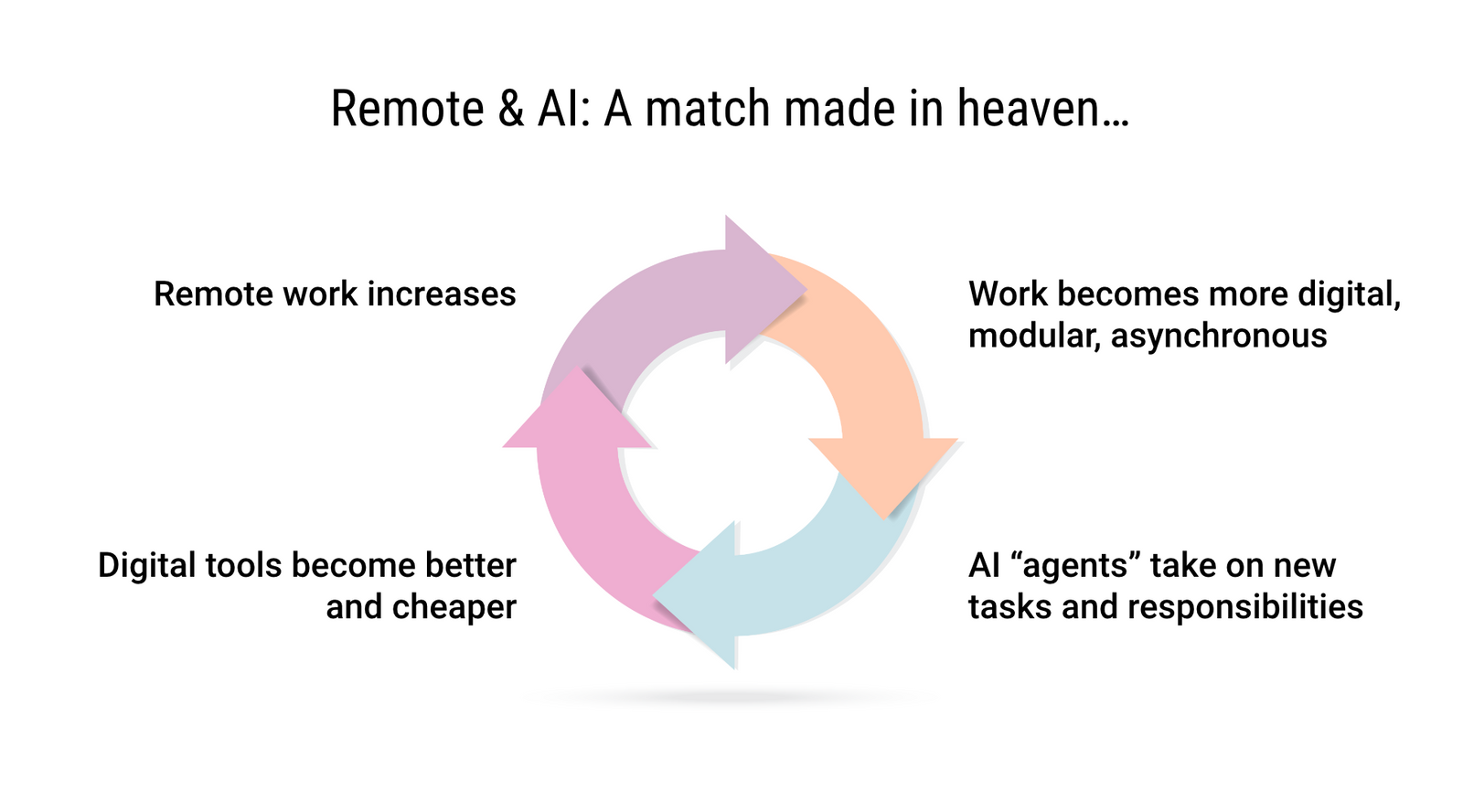

Earlier this year, I wrote that AI and remote work are a match made in heaven:

Remote Work and AI have a symbiotic relationship. The shift towards remote and hybrid work models has opened doors for AI-driven chatbots and virtual assistants to join the workforce. AI, in turn, enhances remote collaboration by improving communication tools and incentivizing humans to rely even more heavily on digital communication and modular work.

This dynamic is illustrated in the chart below:

But AI's impact on distributed work does not end there. It also intensifies competition for talent, which, in turn, pushes companies to hire from more locations and adopt more "liberal" attendance and scheduling policies.

And, more broadly, as AI takes on more tasks, humans are "pushed" to perform work that is more creative, specialized, and scalable — which means companies need to hire across more locations (and larger talent pools) in order to match people to increasingly specific jobs. More on "matching" in a moment.

6. AI will dramatically change the real estate business.

A few years before Covid, I got a call from a headhunter. She told me one of the three largest real estate owners in the world is looking for someone to head their innovation department. I didn't think it was for me, but it was too serious to dismiss outright. After completing a series of idiotic online evaluations, I was invited to a series of interviews. It was a series of meetings with very arrogant, old (sorry) dealmakers who knew nothing about tech, innovation, or much else beyond their direct area of expertise (structuring real estate acquisitions).

The final interview was with the most important decision maker — the CTO. The guy in charge of procuring antivirus software and keeping everyone's email working was supposed to figure out how the company should innovate. In a serious company, such an effort would have been led by the CEO and the board.

Before COVID-19, too many real estate companies thought of "tech" as some sort of patch you buy off-the-shelf while the rest of the business continues uninterrupted. Recently, more of them are starting to understand that "tech" affects everything - corporate strategy, corporate structure, funding sources, even the structure of the whole industry and the nature of the asset (more on that in a moment). Of course, those who read Rethinking Real Estate had a head up, but most still treated the book's insights and predictions as something relating to some far-away future, not to the immediate months after publication.

AI will intensify everything we've seen in the past few years. It will push technology deeper into the heart of the real estate business, it will force companies to take on whole new activities or give them up completely and rely on new operating partners, and it will require new funding structures to pay for all the new talent, tools, and activities that will become table stakes. If you're still hoping your CTO will figure it out for you, you're in for a particularly bumping ride.

7. AI will dramatically change real estate demand and supply.

AI will affect how, where, and even why people work. It will intensify the two key trends of the past few decades — (1) fewer people will be required to generate the same amount of economic activity, and (2) the broad middle class of office workers will split into a narrower group of very-high earners and a much broader tier of service workers of various kinds. Coupled with remote and distributed work, it will drive a reduction in overall office demand, a redistribution of some remaining demand into new regions across and within cities, and a change in the design and operation of the spaces that remain in demand.

Some hope that the AI boom will drive an overall comeback for the office market, but the data is not encouraging. Consider the case of San Francisco, the Mecca of AI. Using data from CBRE, Avison Young, and JLL, I put together the total leasing demand from AI companies alongside current vacant space and leases set to expire in 2024. As you can see in the chart below, AI office demand doesn't even begin to address the shortfall in office demand. Things are likely to get much worse as 80% or so of pre-Covid leases come up for renewal over the next few years; many of them will not be renewed or will downsize.

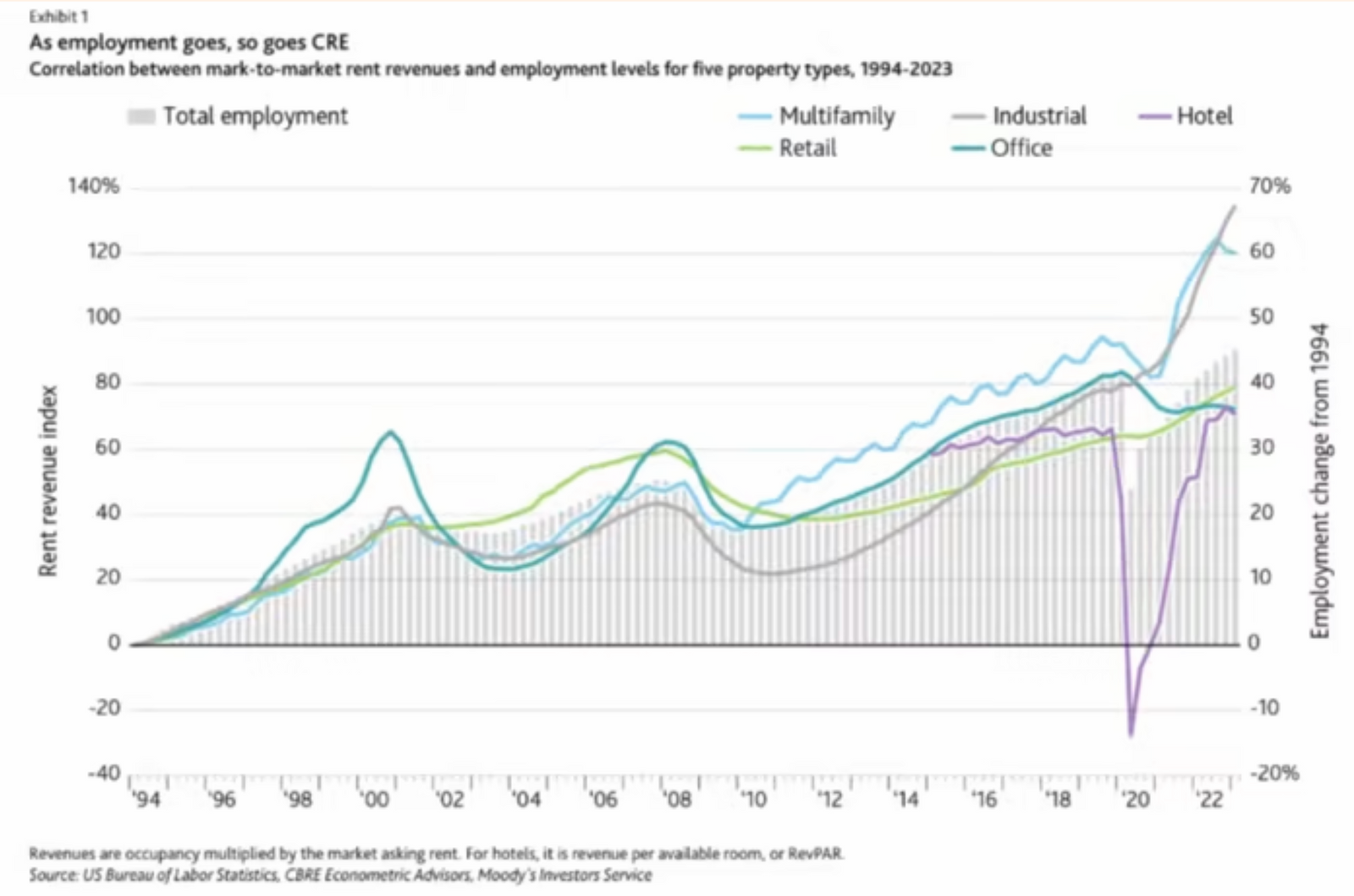

OpenAI, the poster child of the current AI boom, also offers an interesting data point. Twenty years ago, Google needed 2,500 employees to generate $1 billion in revenue. OpenAI only needed about 700 employees to reach the same level in 2023. A billion dollars ain't what it used to be, but the 4-times difference illustrates a broader trend of fewer employees required per unit of revenue. This means it's possible to have an economic boom and an office crisis at the same time. This is already happening. As recent data from Moody's shows, there is already a decoupling of total employment and office rents.

8. AI can help mitigate some of the challenges it creates.

AI will introduce a lot of uncertainty and change to real estate markets, but it will also provide many new tools to help investors and operators make better decisions, cut costs, and provide a better experience to their customers. Hewsan Pang at Thesis Driven provides an overview of some of these tools.

9. AI will redefine the meaning of urban agglomeration.

As the internet opened up to consumers in the mid-1990s, "experts" immediately predicted that offices and urban centers would decline in importance. But the immediate effect was quite the opposite. The internet and the broader tech boom spurred an urban comeback, concentrating economic activity in larger offices at the heart of superstar cities.

This comeback was explained by three complimentary theories:

- As the economy becomes more dependent on technology, in-person work becomes more important because "collisions" between people within and between industries increase the rate of innovation. This theory is most associated with Harvard Professor Ed Glaeser.

- As the economy becomes more dependent on high-skilled individuals, the biggest cities become more important because these individuals like to live in large, diverse cities that offer culture, dining, and other unique amenities. This theory is most associated with University of Toronto Professor Richard Florida.

- As work becomes more specialized, there are higher returns to hiring from the largest possible labor pool in order to match the right person to the right task. As with dating, if you have a long list of requirements, you're more likely to find the perfect match in a large city rather than a small village. This theory is most associated with UC Berkley Professor Enrico Moretti.

These theories made sense, but they failed to predict the reversal in urban fortune that started around 2015 and culminated in the early 2020s. Large cities continued to lose population, companies split their headquarters into multiple locations and/or embraced remote and flexible work, and tapping the largest possible labor pool turned out to mean hiring from anywhere rather than from one big city. And yet, these theories are still relevant to understanding the future, albeit with different implications from those initially described by their authors and most of their readers.

In-person work will indeed become more important but for fewer companies and people. Even the meaning of "in-person" will change as remote collaboration becomes more engaging and life-like and as in-person meetings become increasingly mediated by digital tools.

Lifestyle will become an even bigger factor in determining where top talent lives, but distributed work will enable people to choose from a much longer list of locations. You no longer need to be in San Francisco or New York in order to access top-paying jobs or work for the best employers on earth.

The returns matching specialized talent to specific tasks will continue to increase, but the main implication of this increase will be that more companies will give up 9-to-5 in-person collaboration in exchange for hiring across many more locations, with most employees either spread between multiple offices or working from home.

10. AI will drive up the premium on some physical interactions.

Some good news, at least in the narrow context of real estate: AI will make it impossible to believe anything you see or hear unless you're actually there. The rise of deep fakes, generative video and voice, and other surprises will turn in-person into a premium segment. Don't get me wrong, more of our interactions will be online, but those that must be offline will become more valuable than ever.

As Ben Thompson pointed out recently, AI is "spoiling" the internet by flooding it with content.

I suspect we humans do better with constraints; the Internet stripped away the constraint of physical distribution, and now AI is removing the constraint of needing to actually produce content. That this is spoiling the Internet is perhaps the best hope for finding our way back to what is real. Let the virtual world be one of customized content for every individual, with the assumption it is all made-up; some may lose themselves to the algorithm and AI friends, but perhaps more will realize that the only way to survive online is to pay it increasingly little heed.

The way to maintain a healthy social life and a firm grasp of reality requires plenty of physical presence and interaction. Sadly, most people will probably learn to live without either. This, too, means that overall demand for solid real estate might decrease, but the good assets and experiences that are in demand will carry higher premiums.

Bonus: Physical places and spaces in a nonlinear world

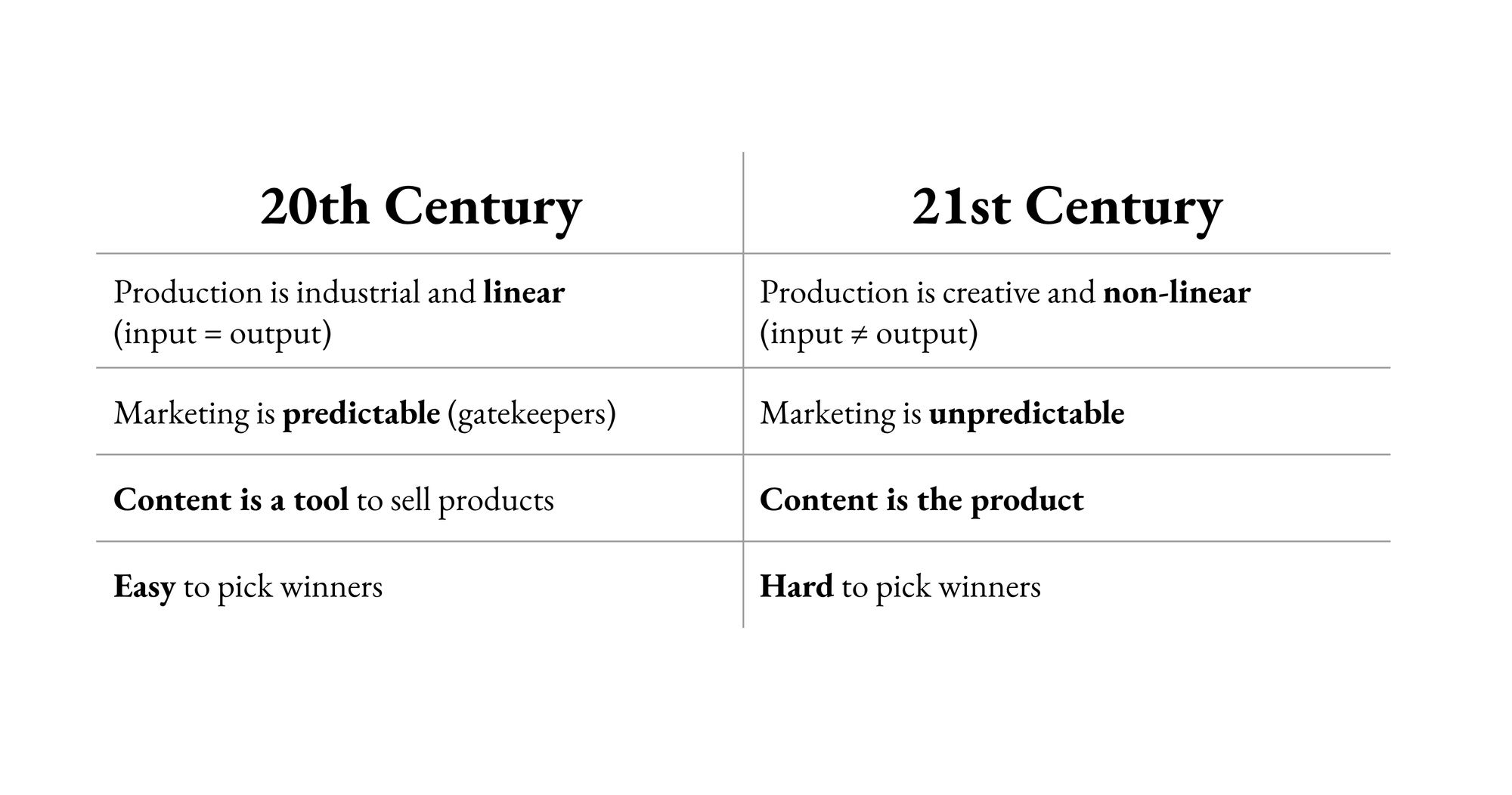

Ultimately, the physical world will have to adapt to accommodate a society and economy that are increasingly unpredictable, volatile, and polarized. We are moving away from the "normal" industrial economy where labor, equipment, and capital produced reliable outputs; a handful of media gatekeepers provided reliable access to people's attention, and it was relatively easy to keep winners and make plans.

We are moving towards what I call "The Nonlinear Economy," where production is increasingly creative and unpredictable, governed by social cascades and inscrutable algorithms; where the marketing happens across infinite channels and conversations that no one truly controls, and where content is not just a way to sell products but often the products itself. In such a world, it's much harder to pick winners or make long-term plans.

This shift is the true driver of the growing demand for flexibility across all types of assets — offices, housing, retail, and industrial. A lot of the public conversation focuses on the preferences of spoiled/lazy/Millennial/Gen-Z employees and consumers, but the real demand for flexibility comes from a deeper change in the nature of our economy. It is the corporations and investors themselves that are looking to mitigate their risks by making shorter commitments and avoiding any long-term plans.

The built world will have to figure out how to accommodate these demands. We've seen some efforts to that effect, some (Airbnb) more successful than others (WeWork). But plenty of experimentation is required to figure out the right way to build, design, finance, and operate the type of assets required by the nonlinear economy.

Let's get to work.

🎤 Are you looking for a keynote speaker for your next event, corporate offsite, or investor meeting? Every year, I inform and inspire thousands of executives across the world. Visit my speaker profile to learn more and get in touch with my agent.

Dror Poleg Newsletter

Join the newsletter to receive the latest updates in your inbox.