Zucked and Musked

The first-order effect of remote work is emptier offices. The second-order effect is leaner companies. The third-order effect is more inequality and opportunity.

🎧 An audio version of this article is available below and on Spotify, Apple Podcasts, and beyond.

People thought Mark Zuckerberg was bad at running a social media company. And then Elon Musk took over Twitter. Two of the world's most hated (and admired) CEOs take a different approach to office work. But both approaches are bad news for traditional offices.

2.5 years ago, Zuck speculated, "Over the next 5-10 years, I think we could have 50% of our people working remotely." Back then, this was a bombshell announcement. Most other employers and landlords expected office work to return to "normal" within weeks.

Around the same time, during the May 2020 lockdowns, a Gallup survey found that 49% of the people currently working from home want to work at the office "as much as they did pre Covid."

This was considered good news. Employers and landlords found solace in the fact that so many people were eager to return. But as I pointed out back then, "A glass can be half full and remain valuable. An office building can't."

But people working from home was only the beginning. In June 2020, I noted that there's a more significant shift that most analysts are missing:

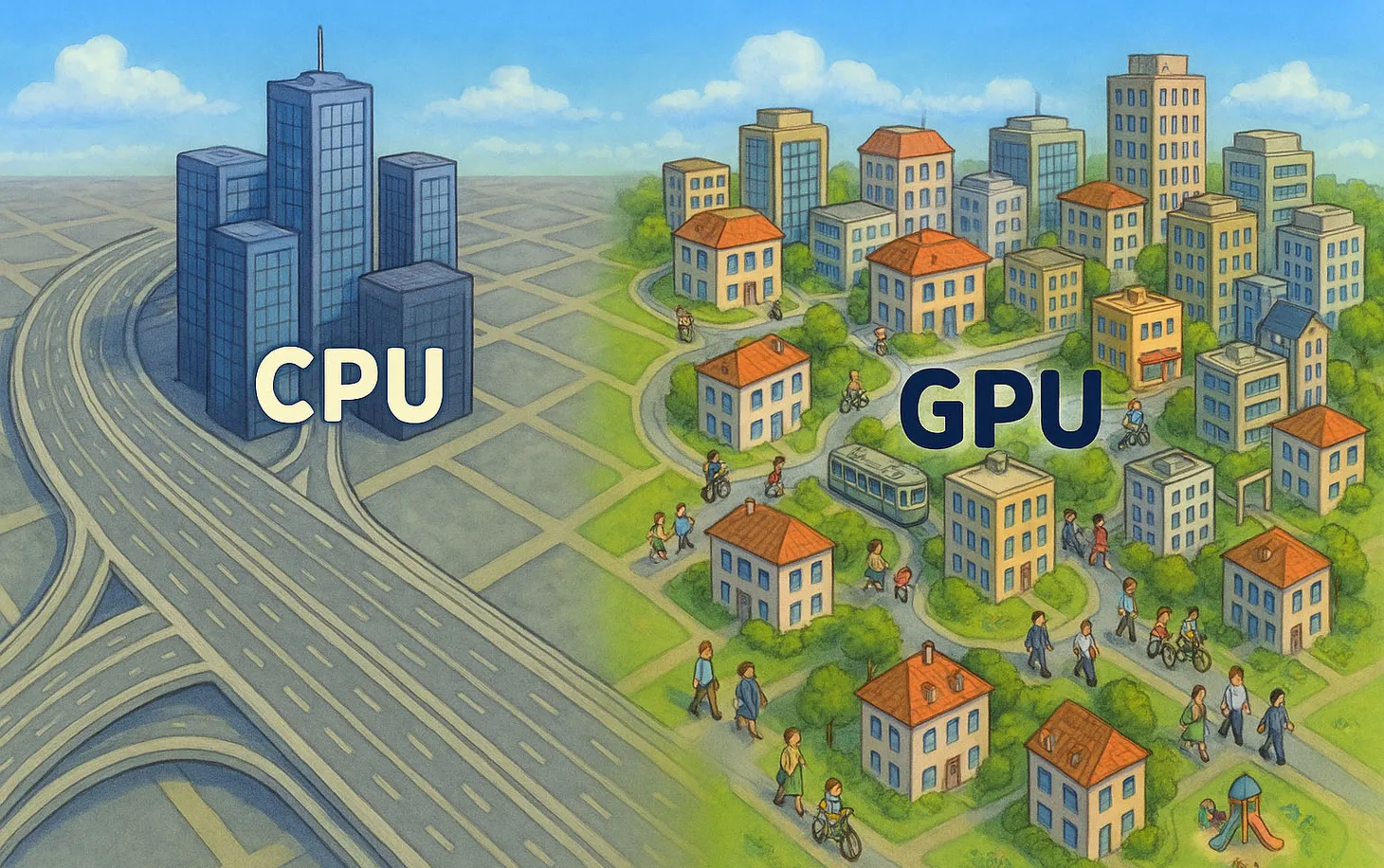

Remote work doesn't just move some jobs out of the office — it also makes it clear that many office jobs are not necessary. This trend was hard to notice amidst the general Covid turmoil. But it is becoming easier to see now.

Immediately after taking over Twitter, Elon Musk started firing people. Before long, more than 70% of the company was gone. At some point, there were fears that the site won't survive the weekend.

But it did survive. And it has remained up for a few weeks since. Perhaps at some point, the whole thing will fall apart. For now, it looks like it can keep going with far fewer employees. As some pointed out, the actual impact might be felt in the long term when Twitter fails to ship new features or improve. But Twitter already failed to ship new features and improve when it had all those employees that are now gone.

The above is not meant to ignore the hard work of Twitter employees over the past decade. It is simply stating a fact: Among its peers, Twitter had the lowest revenue per employee, and even during the craziest bull market the world has ever seen, the company's market capitalization barely touched its 2013 highs. The high price Musk paid for Twitter represents a 16% decrease in value since the beginning of 2014. For comparison, Facebook, another troubled social media company, is up 116% during the same period — and that's after dropping more than 70% from 2021 highs.

And yet, in the face of massive layoffs, some employers and landlords still saw a silver lining. Musk insisted that everyone work from the office. He even converted some meeting rooms into sleeping rooms to make it easier for him and others to stay at work indefinitely.

But tech investors saw the news for what it is. As Scott Galloway pointed out, investors are starting to push large and small companies to attempt similar layoffs. The sentiment is captured in a letter sent by TCI Fund Management, an investor with more than $6 billion worth of Alphabet (Google) shares:

"We are writing to express our view that the cost base 0 of Alphabet is too high and that management needs to take aggressive action. The company has too many employees and the cost per employee is too high...

our conversations with former executives of Alphabet suggest that the business could be operated more effectively with significantly fewer employees."

The letter quotes Brad Gerstner, CEO of investment firm Altimeter Capital:

"It is a poorly kept secret in Silicon Valley that companies ranging from Google to Meta to Twitter to Uber could achieve similar levels of revenue with far fewer people."

This type of pressure is driving layoffs across the tech industry. Some readers have noted that it's not surprising that tech companies are bloated after a decade of fast growth and cheap money. It's only natural for them to "shed some fat." But most of these companies are still growing and will continue to grow over the next decade. And the whole point is that their workforce was (relatively) unproductive, even during the best of times.

There's also a second reason to maintain such a large workforce. As I wrote earlier this year, over-hiring is a way to deal with the non-linear nature of creative work:

"One of the biggest challenges of modern business is the role of chance events in determining a product's success. Companies can no longer simply "hire good people" and "develop products that sell."

We are no longer in a linear, industrial economy in which the right inputs are very likely to produce the right outputs. Instead, we are in an economy in which the right inputs are just table stakes; they are a lottery ticket. But the right outputs — the things that become successful — are those that happen to draw the attention of the crowd at the right moment and, in turn, are boosted by algorithms that turn initial success into ultimate, absolute success."

Over-hiring is not the only way to deal with this uncertainty. There are also other approaches:

In some industries, companies deal with this uncertainty by avoiding any attempt at innovation. This is the reason why the most successful movies of the 21st Century are remakes or extensions of earlier, already-successful movies. Trying something new is too risky. As long as it is viable, recycling remains the most logical strategy. But it is not always viable. And in other industries, companies must make multiple bets in order to have a fighting chance.

Tech giants treat employees as bets. As long as one of them might come up with the next Instagram or Gmail, it is worthwhile to employ a bunch of them and see how it goes. Worthwhile, that is, as long as you can afford it:

"These companies are not recycling ideas, but they are recycling capital. They are using billions made from past successes to bet on employees who will maybe develop a future success that will help finance even more bets. This dynamic is painfully visible in companies like Google, Facebook, and Apple, who are hoarding a huge chunk of the world's talent — throwing people and ideas at the wall to see what sticks."

At some point, you run out of money to finance this strategy (Twitter). Or your investors run out of patience (Google). Or your founder decides to spend more money on other bets (Facebook). Or a Chinese competitor (TikTok) and app-store privacy restrictions (Apple) are eating your margins and forcing you to cut costs (Facebook). For whatever reason, hoarding talent becomes unsustainable.

Twitter is proof that a company can go remote even if it forces everyone back to the office. The biggest change is not in where people work but in how people work.

Where does that leave offices?

Wherever they were, to begin with. They can't move. But they can get emptier. The first-order effect of remote work is emptier offices. The second-order effect is leaner companies and even emptier offices. The third-order effect is an explosion of inequality and opportunity. But that's a story for another time.

Dror Poleg Newsletter

Join the newsletter to receive the latest updates in your inbox.